“SELL your islands, you bankrupt Greeks – and the Acropolis too!” Such was the furious headline of Bild, Germany’s leading tabloid, when the dire state of Greece’s finances was first revealed. At the time this sounded like a bit of crass populism. But one year on, it has pretty much become the message of Europe’s finance ministers.

At the end of a late-night meeting in Brussels, ministers from the countries that use the euro delivered a harsh message that Greece had to push through more reforms before it could hope for more relief from its partners, be it an additional bail-out programme or a rescheduling – or “reprofiling” – of its debt mountain.

“Urgent measures are needed in Greece in order to reach its fiscal targets,” said Jean-Claude Juncker, the prime minister of Luxembourg and chairman of the meeting. He said Greece had to “increase the volume of privatisation” as well as adopt further belt-tightening measures to meet its deficit-reduction target this year.

Christine Lagarde, the French finance minister, said Greece had so far failed to act on its original promise to raise €17 billion from the sale of state assets. This figure was raised earlier this year to €50 billion. She said it was important for Greece to take a leaf out of the book of Portugal (its bail-out was approved today), where both government and opposition parties have pledged to support the reform programme negotiated with the European Commission, the European Central Bank (ECB) and the International Monetary Fund.

The Netherlands said it had won some support for a more radical measure: creating an external agency run by the EU to take charge of selling the assets. That is an erosion of sovereignty that is likely to run into fierce resistance, and not just from Greece.

A growing number of economists believe Greece’s debt, already at about 150% of GDP, cannot be repaid. Some advocate “hard” restructuring, in other words imposing losses on creditors. Germany has been pushing a softer rescheduling of the debt to delay repayments, or “reprofiling”.

But Mr Juncker said: “It is not reprofiling or nothing. It is (reform) measures and measures and measures, and then maybe reprofiling.”

But even after hours of talks, the ministers struggled to keep a consistent line. Ms Lagarde insisted that both restructuring and rescheduling were “off the table”.

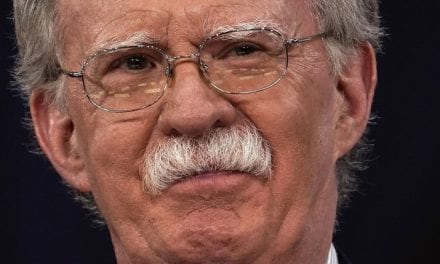

George Papaconstantinou, the Greek finance minister (pictured above, talking to Ms Lagarde), backed this version of events. And he insisted that ministers had not been as harsh as may seem: they acknowledged the unprecedented reduction of Greece’s budget deficit, worth 7% of GDP. “At the same time they acknowledged that we need to do more. We concur.”

The meeting unanimously endorsed the appointment of Italy’s central banker, Mario Draghi, to succeed Jean-Claude Trichet as president of the ECB later this year.

Asked whether the absence of Dominique Strauss-Kahn, the IMF’s boss remanded in jail in New York on charges of sexual assault, Mr Juncker said he had been “close to tears” at the sight of his friend in handcuffs. He refused to be drawn on whether another European should replace him. Ms Lagarde, for her part, said she did not want to discuss speculation that she might be a candidate for the top IMF job.

In short, the ministers seemed to agree on little – except that the Greeks had to start selling, selling, selling.