by Solomon Teague, Euromoney

Concerns that Greece could be on the verge of leaving the euro are back to the fore after the country called elections that could usher in a government determined to rip up the existing aid agreement – but analysts doubt the brinkmanship will lead to Greece leaving the single currency, let alone a full-scale euro break-up.

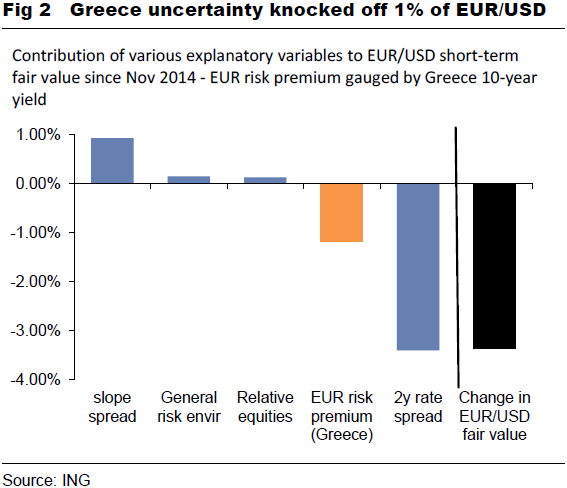

Markets could be forgiven for pinching themselves amid a strong sense of déjà vu. Talk is again dominated by the possibility of Greece leaving the single currency, and the potentially seismic implications of such a development, with strong echoes of fears seen in 2012. Yet despite the similarities, closer inspection reveals a different mood ahead of such an outcome. In 2012, a Greek departure was seen as nothing short of apocalyptic – for the euro and the world economy. Today, the mood is rather more sanguine, with the fate of Greece seen by many as a localized issue, rather than an existential threat to the single currency. Geoffrey Yu, G10 FX strategist at UBS, says even if Greece does leave the euro "it won't lead to wider break-up risk and we believe the contagion effect will be limited". Petr Krpata, FX strategist at ING, agrees, saying: "The Greek-related risk looks to be so far contained to Greek assets, rather than being a source of contagion." And it is the perception of the level of contagion that underpins many peoples’ views about the implications of such an event, were it to occur. "Grexit would be very bad for the euro, but only if it were contagious across European markets," says Kit Juckes, global strategist at Société Générale.

However, Yu at UBS believes the significance of any departure from the single currency cannot be measured in economic terms alone, noting it would show the euro is not irrevocable, contradicting the European Central Bank and eurozone politicians who have spent considerable time and capital seeking to assure markets it is. "That means much more for the concept of the euro rather than simple market/economic fundamentals," he says. Nicholas Ebisch, analyst at Caxton FX, says: "The value of the single currency is upheld by faith that the EU will stay together, and Greece exiting the euro will weaken the perception that there is value in the single economic bloc." Ebisch says if Greece were to leave it would be "the dynamite that starts the landslide for the eventual destruction of the euro", suggesting it would pave the way for other troubled eurozone economies to follow suit, potentially leading to the complete disintegration of the currency. Left-wing support The issue is back on the table as Greeks, weary from years of austerity, prepare to go to the polls in coming weeks, with surveys showing strong support for Syriza, the left-wing party that has vowed to end Europe-imposed austerity. Syriza appears to have a strong hand. In 2012 Greece – and other peripheral countries – ran a sizeable primary fiscal deficit, meaning even default would not enable the government to run the country without external financing. This year Greece expects to run a primary budget surplus of 3% of GDP, meaning the government could run the country without external financing. This might make withdrawal from the euro and default a more attractive option than it was. However, while few deny Syriza is likely to do well in the coming elections, scheduled for January 25, many believe the bellicose rhetoric of its leader Alexis Tsipras will not be translated into such radical policies in office. Yu says: "Despite Syriza support, poll after poll show overwhelming public support for the euro to remain the currency of Greece, so both sides will try to reach a negotiated settlement."

Caxton’s Ebisch notes that Grexit itself "is seen as very unlikely, as it would mean disaster for the single currency and would destabilize the eurozone economy, which is already struggling with a low rate of growth. The EU would be expected to keep Greece in the euro by any means necessary, should a situation arise during which Greece threatens to leave." However, if people have misjudged Tsipras, and Greece does force its departure, the mood within Europe is likely to sour quickly. Simply by setting the precedent, a Greek departure from the single currency would be bound to increase investor worries about the future of other troubled economies, such as Italy and Spain. "During the first round of eurozone existential crisis in 2010, the break-up risk premium built into EUR/ USD was close to 10% and we would not be surprised to see a similar magnitude of the risk premium should Grexit become above a 50% probability," says ING’s Krpata. "Although one can rightly argue that the likes of Italy, Spain and Portugal are in better shape than in 2012, we doubt these assets, as well as European equities, would remain unchallenged should the probability of a Grexit rise materially." Despite all this, European authorities, especially those in Germany, appear confident they have the institutional framework to cope with Grexit. Press reports suggest German chancellor Angela Merkel is now prepared to consider Greece leaving the euro, something regarded as unthinkable in 2012.