By Aristofanis Papadatos, seekingalpha.com

- As the left, anti-austerity party will probably win the elections on January 25th, many analysts forecast that Greece will be the first member to exit Eurozone.

- Whether Greece should return to its own currency has become so emotional across politicians and analysts that very few, if any, explain their thesis based on economic fundamentals.

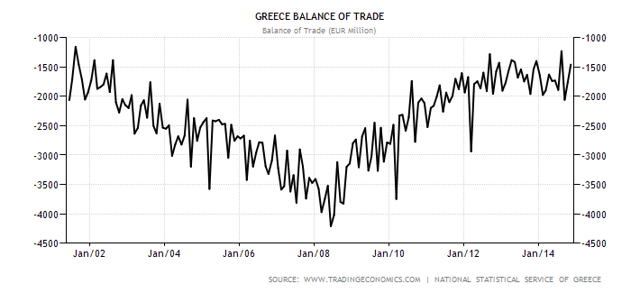

- The article discusses this issue based on economic fundamentals. For instance, the trade deficit of Greece skyrocketed, from $15 B to $48 B, in its first 6 years in Eurozone.

The potential exit of Greece from eurozone has become one of the most popular themes in the news lately. As the left party will probably win the elections on January 25th and has an agenda against any further austerity measures, many analysts forecast that Greece will be the first member to exit eurozone. They also characterize that outcome as catastrophic for the country. In this article I will explain why it will actually be beneficial to Greece to exit the euro but why I believe Grexit will not happen.

First of all, the issue of whether Greece should return to its own currency has become so emotional across politicians and analysts that very few, if any, explain their thesis based on economic fundamentals. When evaluating whether Grexit is good for Greece, one should keep in mind that a strong currency (euro) has one main advantage and one main disadvantage for any country that adopts such a currency.

The disadvantage is that the country's exported goods become much more expensive for the other countries and hence the exports of the country substantially decrease. In the same way, the imported goods become much cheaper for the country with the strong currency and hence the consumption of imported goods greatly increases. This is exactly what happened in Greece when it switched from its weak currency (drachma) to euro in 2002.

It should be noted that the graph shows the trade deficit per month and hence the consequences of adopting the strong currency have been much more severe. More specifically, in the first 6 years after Greece joined the euro, its annual trade deficit more than tripled, from $15 B to $48 B (16% of GDP!). This devastated the local economy, resulting in the closure of numerous small factories of many sectors, such as clothing, shoe manufacturing etc.

Of course most Greeks were happy with euro, as they kept buying imported goods, such as cars, electronic devices, gasoline and flight tickets at much lower prices than they used to. Thus they changed their consumption habits and started to replace their cars every 5 years instead of 20 years and traveling abroad more than once a year (vs. once in 3-5 years in the past). What they did not realize was that their increasing consumption of imported goods was devastating their economy. It is not accidental that the vast majority of the countries, even the US and China, have chosen to have a weak currency to keep their economy healthy.

On the other hand, there is also one benefit that countries with a strong currency may enjoy. This is the fact that a strong currency tends to attract significant investment amounts from abroad, as foreign investors want to invest only in strong currencies in order to achieve a satisfactory return on their investment. If they invested on a weak currency, which lost for instance 10% of its value every year, those investors would probably face serious losses after a few years. Therefore, the (strong) euro has this beneficial effect for the countries of eurozone.

However, Greece has not experienced any significant money inflow from foreign investors. This has nothing to do with euro but it is due to its extensive bureaucracy and corruption, which are very similar to what one witnesses in the countries of Latin America. Foreign investors do not dare to invest in Greece because its bureaucratic and corrupted mechanisms can extremely delay any process of a business and blackmail a company, asking for excessive amounts for just a normal procedure to be completed.

Therefore, while euro is probably the ideal currency for the Northern members of eurozone thanks to the efficient structure of their economies, it is fatal for Greece, as the latter cannot enjoy its positive side (foreign investment), while it suffers very intensely from its negative side (trade deficit). Moreover, considering the small scale of Greek enterprises vs. its peers from Northern Europe, there is no way that the Greek enterprises can compete against their competitors. Therefore, it is not surprising that even imported groceries from Latin America show up in the supermarkets' shelves cheaper than the local products.

That's why Greece should exit the euro; actually it should never have entered the euro but now that the first mistake has been made it is very important to stop the bleeding process and press the reset button. To be sure, in the last 6 years, Greece broke the world record in accumulated recession; more specifically, the country has experienced a cumulative recession of 29% (shown in the chart), even more severe than the Great Depression of 1929.

Even worse, there has been a 30% reduction in the average salary, 20% of the population is under the threshold of poverty and there has not been any structural improvement in the economy, as the bureaucracy and corruption mechanisms still thrive. Therefore, Greece should return to its own weak currency and start devaluing it at a slow, steady pace, just like what it did in the 30 years before switching to euro. Of course this solution will impart pain to Greeks in the short term (the first 1-2 years), in the form of a bank run and a temporary supply shortage of imported goods, but it will be extremely beneficial in the long term.

Unfortunately for the country and against many recent headlines, the country will not exit eurozone, at least in my opinion. As experience has taught us, all Greek and European political parties prefer the path of least resistance. More simply, they prefer to do the minimum changes required to complete their term, postponing the radical solution of every issue far to the future so that someone else deals with it. Thus the new Greek government will probably follow the path of its predecessors and try to make the fewest possible changes that will keep it in agreement with Troika. Of course, in the beginning the left party will refuse taking new austerity measures, as it has promised so in its campaign. However, when it faces the dilemma of accepting the austerity measures or exiting the euro, it will prefer the former, as the latter involves walking in uncharted waters, such as solving cash problems of banks, dealing with temporary supply shortage of imported goods, the outrage of citizens, etc.

As a Grexit scenario would be very painful for the country in the short term (albeit good for the long term), it has pronouncedly suppressed the value of the Greek stocks. Therefore, as I believe that scenario will not materialize, I expect the Greek stock market (NYSEARCA:GREK) to greatly appreciate (approximately double) from its current level in the next 1-2 years, as the current valuations of most stocks have recently become too cheap. The pressure will probably continue as we will be heading to the elections and it will also continue when the new government initially disagrees with Troika on the austerity measures; this is actually the point at which I expect the bottom to be recorded. After that, any hint of agreement with Troika will set the Greek stock exchange for a breathless rally of many months.

It is also very interesting to note a striking divergence of the Greek stock market index vs. the previous elections, in June-2012. On the one hand, the context is identical, i.e., the market is afraid of the left party winning the elections and leading the country to exit the euro. However, even though the left party will probably win these elections (whereas it was the underdog in 2012), the Greek general index is 56% higher (780 vs. 500) than it was in 2012 in the days leading to the elections. In my opinion, this striking divergence is a strong indication that Grexit is unlikely to occur.

To sum up, whoever has studied ECON 101 really wonders why Greece adopted a strong currency in the first place. It is notable that most economists agree that Grexit will be beneficial to Greece; it is the politicians and the journalists who disagree but most of them are not impartial, as they represent parties and lobbies. Nevertheless, as Grexit will involve walking into uncharted waters for the new government, I believe that the latter will select the path of least resistance, which has proved to be the unanimous choice of all European governing parties in the last decades.