By Mike Bird, Business Insider

Greek Prime Minister Alexis Tsipras and Finance Minister Yanis Varoufakis are back in Athens after a European tour undertaken in an attempt to sell a debt-restructuring deal. But the drama is not over.

On Thursday, Varoufakis visited Germany and invoked memories of the rise of Nazism, saying that his country was going through a period similar to the early 1930s in Germany.

On his return, Tsipras said the country “won’t take orders anymore.” He wants the bailout and austerity agreements made with the country’s major international creditors scrapped, but he hasn’t won any major concessions yet.

So what happens next?

Well, Greece potentially has just weeks of cash left. The bailout, which the government depends on to fund itself, runs out at the end of February.

Varoufakis and the government are asking for a bridging loan from Europe while debt is negotiated — they want something just to tide them over for the next few months, with no strings attached.

The next Eurogroup meeting of the euro finance ministers was pushed ahead to Feb. 11 with Greece back at the top of the eurozone’s list of problems, two and a half years after the end of the euro crisis.

Oxford Economics’ James Nixon expects that Athens will get a bridging loan but that the “ultimate crunch point” will come in July and August when Greece has other major debt repayments to make (his colleague, Gabriel Sterne, thinks it may come sooner). It’s not clear what happens if there simply isn’t support for a temporary loan this month and other European countries decide to bring that crunch point ahead.

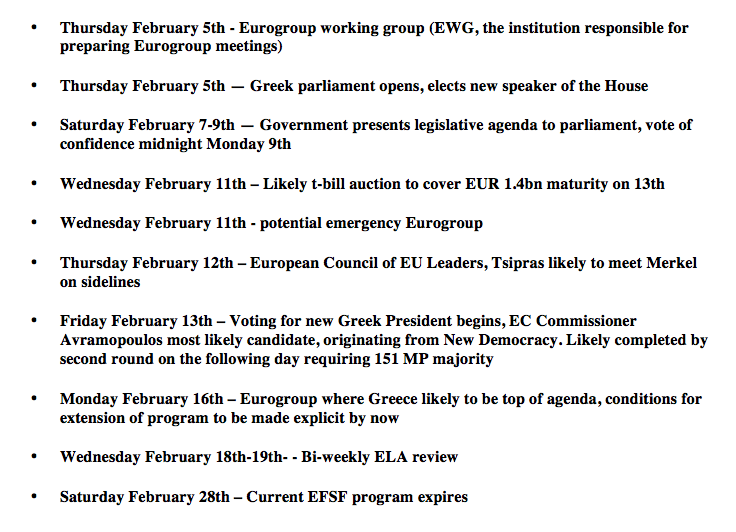

Here’s a timeline from Deutsche Bank for what’s going on in Greece during February. It looks like the 11th and 16th will be the most important dates:

Deutsche Bank

Deutsche Bank

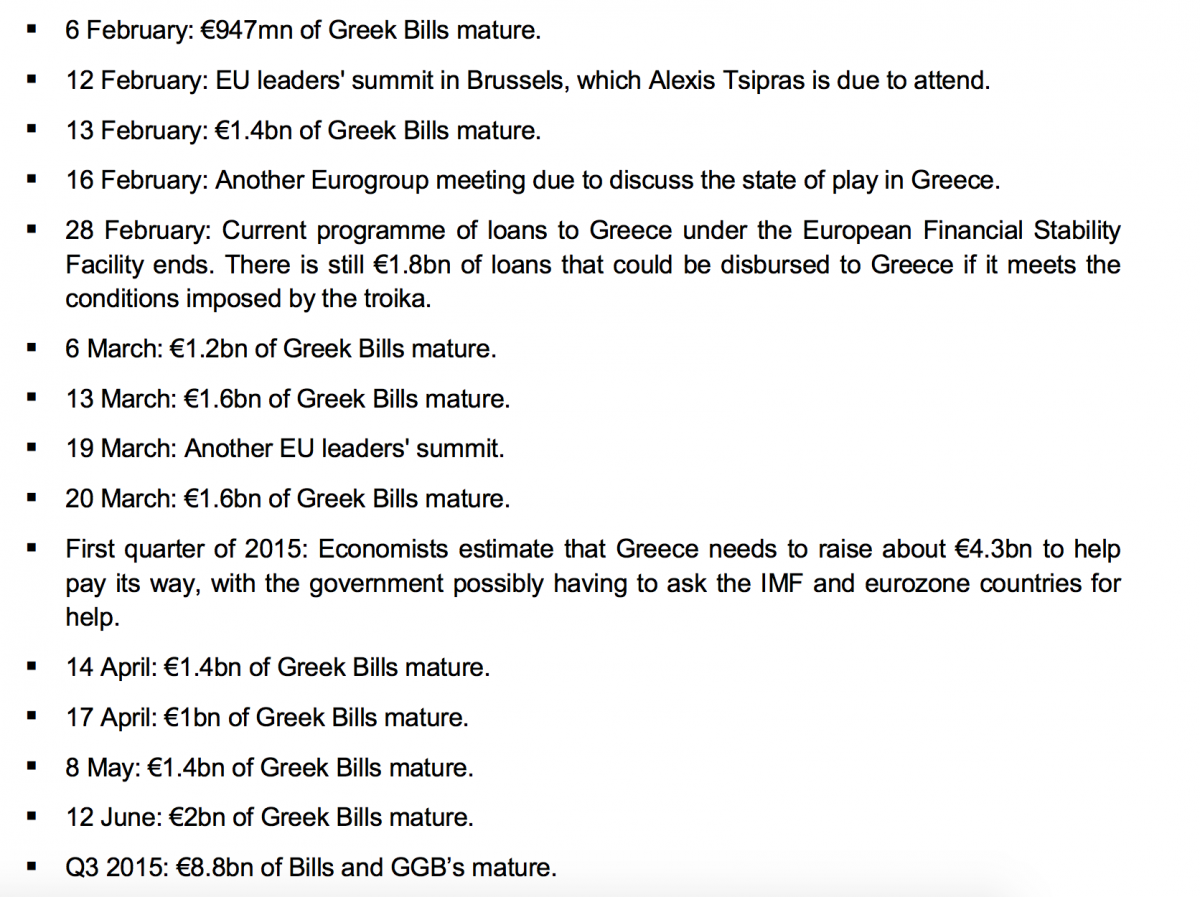

BNP Paribas has a useful timeline showing how pressure will build on Greece after the bailout funding ends. They’ll have a lot of large bond payments to make: