By Tim Worstall, Forbes

That Greece should leave the euro is something that is pretty much established as the revealed truth in Anglo-Saxon economic and commentary circles. Sadly it is not so established either in European economic circles nor in any political ones. European economics seems to be almost deluded on this point and of course the politics is just toxic. For the euro is considered to be a cornerstone in that myth of ever closer European unity and that must proceed, whatever the suffering inflicted upon Greece or the Greeks.

We have two more people calling, if not directly, for Greece to leave. The first is Hans-Werner Sinn over in the New York Times. He is at least direct:

THERE are not many issues on which I agree with my colleagues Paul Krugman and Joseph E. Stiglitz and the former Greek finance minister Yanis Varoufakis. But one of them is the view that an exit from the eurozone would be advisable for Greece.

Why?

The public credit has delayed a Greek bankruptcy, but it has failed to revitalize the Greek economy. To compete, Greece needs a strong devaluation — a relative decline of its price level. Trying to lower prices and wages in absolute terms (for example, by slashing wages) would be very difficult, as it would bankrupt many debtors and tenants.

…

The better alternative is a Grexit accompanied by debt relief, humanitarian aid for the purchase of essential imports and an option for eventual return to the euro. Greece could reintroduce the drachma as the only legal tender. All existing prices, wages, contracts and balance sheets, including internal and external debt, could be converted one-to-one into drachmas, which would immediately decline in value.The devaluation would induce Greeks to buy domestic rather than imported products. Tourism would get a boost, and capital flight would be reversed. Rich Greeks would return with their money, buy real estate and renovate it, fueling a construction boom. As the trade deficit gradually turned into a surplus, creditors would get some of their money back.

Quite so.

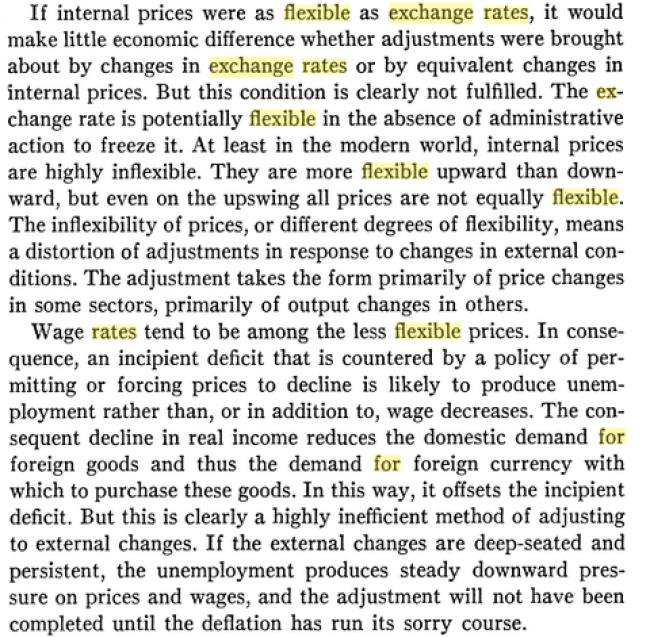

The basic problem is that Greece’s wage level is too high for the productivity level of that labour. How it got into this problem isn’t really the point. Yes, it happened because the Greek government was vastly spendthrift: but stopping the government of Greece being spendthrift doesn’t solve the problem. Finland’s problem is the same: the internal wage level is too high but that’s as a result of the joint implosion of Nokia and the forestry industry. Different causes, same problem and the solution in both cases is the same. As Milton Friedman pointed out decades ago:

It’s neither more moral nor a matter of just desserts to call for that internal devaluation, that austerity, than it is to call for the currency devaluation. Indeed, I would argue entirely the other way: the currency devaluation will cause a lot less human pain so that’s the way the problem should be solved. Thus Greece must leave the euro because that’s the way to solve the problem with the least pain.

Brad Delong looks at the European success story of adjustment:

Using Iceland as our measuring stick, the cost to Greece of not exiting the eurozone is equivalent to 75% of a year’s GDP – and counting. It is hard for me to believe that if Greece had abandoned the euro in 2010, the economic fallout would have amounted to even a quarter of that. Furthermore, it seems equally improbable that the immediate impact of exiting the eurozone today would be larger than the long-run costs of remaining, given the insistence of Greece’s creditors on austerity.

That gives a quite startling proof of the ludicrousness of the eurozone policy. The idea that the entire bankruptcy of a whole country, the wiping out of all of the financial sector, a currency that falls 75% near overnight (leading to pretty much all mortgage holders being underwater, many had borrowed in foreign currencies) leads to a less bad outcome than the one imposed upon Greece by the Very Serious People. So, yes, Greece really should leave the euro, should have left the euro 5 years ago. This isn’t quite as extreme as my own view that it should never have been allowed in and shouldn’t have entered even when it was allowed but still. I acknowledge that I am an extremist on these issues, thinking that the euro is a bad idea for everyone, heck, that the European Union itself is a bad idea.

Delong isn’t that far along that road but nearly so:

One would have thought we were capable of learning from the past, and that the Great Depression was important enough in European history that policymakers there would not be repeating its mistakes. And yet, at the moment, that is precisely what seems to be happening.

If Europe, the European Union, really is being run by the economically deluded then perhaps everyone really should leave it?