By Haider Abbas, The Nation

Greece is experiencing turbulent times and at the heart of this situation is the severe economic depression that is worsening day by day.

Despite the gravity of the circumstances, debt and default are terms that are not novel to Greeks.

For example Dionysius the ruler of the Greek city-state of Syracuse faced a similar situation.

He gathered huge debts paying for his extravagant court and vast military campaigns.

Such was the repetitive nature of borrowing and paying that eventually nobody lent him any more money.

In such conditions, Dionysius had a eureka moment and forced all the citizens to hand in their cash.

Then he simply labeled the one drachma coins as two drachmas and alas Syracuse was rich again.

If only the solution to today’s problem was equivalently simple and in all fairness the problem has grown more complicated as well.

In order to understand the most feasible solutions, it is important to first examine the beginning of debt crisis.

I will start first by examining the more conventional narrative about the crisis that holds the Greek government responsible for this mess.

The problem started with Greece distributing a lot of money in pensions and unemployment benefits but not being able to raise the revenue to make these payments.

As a consequence Greece started borrowing a lot of money assuming it could manage all the debt it owed to different institutions but it ignored the fact that other European economies were much stronger which is why they were able to make the payments on better interest rates.

While this was happening it accrued a national debt and the cycle worsened with Greece printing money to fund its deficits.

Then the Eurozone happened and Greece really wanted to join.

In order to join the club, Greece needed to show a certain threshold of debt-GDP ratio, which it achieved by falsely presenting its finances with Goldman Sachs acting as accomplices as reported in the New York Times.

The Benford law that is a tool used to detect manipulations or fraud in accounting data confirmed this.

When the Benford law was tested on data reported by Greece, it showed the greatest deviation among all Euro states.

Even after joing the Eurozone, Greece continued to borrow to make previous debt payments, which was aggravated by tax fraud and breaking news of corruption that resulted in the opposition party being sworn in.

The new government discovered that Greece’s debt ratio was being falsely represented and it was actually 5 times higher than the reported one.

This was followed by the 2007 – 2010 credit crisis when Greece was finally cut off as banks feared it would default and Greece could no longer refinance its banks.

Jump in IMF and ECB who bail Greece out but with strict stipulations of wage cuts and high taxes that would enable it to make future payments.

Greece fails to implement the associated conditions and can’t make the payment, which brings Greece to a debt crisis yet again.

Only this time, the public has outspokenly rejected the harsh stipulations tied with new bailout package.

The criticism grows harsher as economists say that once Greece joined the Euro, it should have used the low interest rate money to pay off the old-higher interest debts.

Instead what Greece chose to do was expand its public sector.

Sounds like a sad story of corruption, over borrowing and misallocation of resources.

While most of this is true, there are several other factors that also need to be taken into consideration and certain assumptions people make while interpreting the crisis that need to be clarified.

First, lending to states should be considered as equity not debt because countries can only be reorganized.

Second, the consequences of bad credit are supposed to be dealt by creditors not debtors.

The creditors behaved poorly and did not make any attempts at encouraging long-term growth with debt relief and fiscal stimulus.

It also needs to be understood that public finances are very different from private finances.

Current account surpluses are not precisely “good” and deficits are not necessarily “bad”.

Similarly there are so many other countries dependent on financing from International institutions that are more corrupt than Greece but yet seem to face no criticism.

And as far is over borrowing is concerned, Japan has a much higher government debt – GDP ratio but it isn’t imposed with austerity measures at all (Japan’s example is only meant to highlight the debt-GDP ratio factor as Japan’s and Greece’s situation are different in many key ways).

So delegating blame on factors such as corruption and over borrowing is a naïve point of view.

This is where the other narrative comes in, namely the Euro.

Given the Greek crisis right now with high unemployment and high debt burden.

What would usually happen is that a country would devalue its currency and print more money, increasing the value of exports internationally, increasing tourism and bringing in foreign investments.

All this would lead to growth helping pay off the deficit.

However this isn’t possible in the Euro since a lot of different economies are combined together and a price of Euro that is suitable for Greece with 25% unemployment is very different from a price of Euro suitable for Germany with less than 5% unemployment.

Even though the solution of combined economies initially worked as Germany could export even more than before because all of these weaker economies they shared a currency with helped keep the Euro cheaper than what the Deutsche Mark would have been.

Greece was able to borrow on lower interest rates and lenders assumed that if Greece neared default, the Germans and French would bail them out and the commercial lenders would be unharmed.

But they ignored the main fact that Greece’s economy was just much weaker than those of its European counterparts and by joining the Euro, Greece was deprived of having an independent currency that it could float to offset other imbalances.

Had Greece still been with the Drachma, the lower currency level could have lowered domestic interest rates, encouraging local investment and making it easier for Greek debtors to service their debts.

But without the devaluation, Greece is at a competitive disadvantage and cannot earn nearly enough money to pay back its loans and.

So when the crisis happened the EU along with ECB and IMF bailed Greece out in exchange for strict austerity measures.

So what really is the problem with the Euro? Fundamentally, the Euro was a political project aiming to portray peace in the region but the economics of it was critically overlooked.

The 19 member states have ceded monetary policy control to the ECB that performs similar functions to those of the Federal Reserve in the United States.

However as economic idea the economies of its members are too big and disparate in comparison, labor mobility is constricted, average living conditions and welfare policies vary significantly across member states making it extremely difficult to have a consistent monetary policy that is appropriate for all members.

For the system to really work the Eurozone needs more political unity that permits smooth flow of financial transfer payments across Europe from rich to poor countries.

An analogy to understand this would be how in the USA, poor states are constantly getting money from richer states through programs such as social security, Medicaid and welfare systems.

The problem in the Euro is that Germans want their tax dollars to help poor German people and not Greek people who in their eyes are all to blame for with corruption and over borrowing.

Regardless, it would be unfair to not mention the political achievements of the Euro that has helped reduce military hostility significantly and achieved profound political integration for which monetary union is just one method.

Given the bleak situation, the next important question is, how do we move forward? One alternative is that of a “Grexit”, meaning that Greece leaves the Euro.

Even though in theory it could work as Greece would restore competitiveness and restore external balance by cutting its wages relative to other surplus countries.

Practically speaking the Grexit route is very problematic with a lot of drawbacks.

The Greek economy has become so inextricably linked to the Euro that economists fear a domino effect.

With the possibility of a Grexit there would be fear of a default.

Bank runs and people withdrawing money from the local banks would exhaust the banks of any cash to loan to local businesses, exacerbating the crisis.

A Greek default could cause similar things happening in Portugal, Spain and Italy and this would cause huge losses to foreign banks and could spark a global financial crisis.

One can also imagine a lot of legal issues as no country has ever exited the Euro and there are no provisions of an exit from the Euro currency union.

The other route is the austerity route, the one in play right now.

Greece is to be bailed out again by the EU, IMF and the ECB in exchange for austerity measures, structural reforms and internal devaluation.

This means cutting wages, prices and government benefits so as to replicate the impact of the devaluation in the currency.

But this also comes with its own problems as people don’t like foreigners dictating terms and cutting wages (the result of the 2015 referendum was pretty one sided) and economically speaking unlike currency devaluation, internal devaluation reduces wages only leaving debts unchanged.

As a consequence of these policies Greece faces a debt burden 177 percent of GDP and a deep depression.

Any more increases in taxes or spending cuts would worsen the depression.

The implementation of such policies on the suggestion of the Troika have contributed to drastic levels of unemployment, poverty and have rendered Greece unable to raise the money on its own to pay the debt.

If this policy stays in place then all of the money Greece receives in bailout packages will be used to pay its lenders (Eurozone nations, IMF and ECB) ($345 billion) with less than 10 per cent going to the Greek economy.

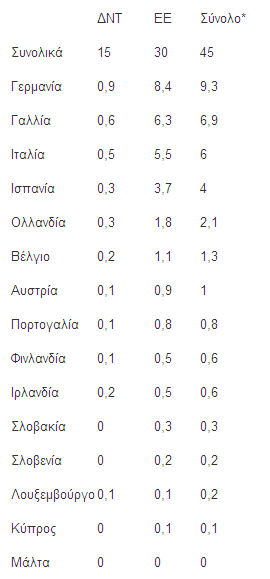

A study showed that since 2010, the lenders have given €252 billion to Greece.

Over the same period, €232.

9 billion has been spent on debt payment and bailing out banks which mean that less than 10 percent of the money has been used for anything else.

Professor Ashoka Mody of Princeton University in his article for the European think tank Bruegel explains the phenomenon of how, the more debtors pay, the more they owe.

He explains that with prices falling in Greece for two years now businesses find it extremely hard to repay their debt, as the original terms of debt repayment do not change despite the lower prices.

This creates a deflationary environment one in which investment and consumption decrease and the government receives less revenue.

The imposition of austerity measures during such circumstances make debt repayment even harder as prices and wages fall even more and this is what he explains is the Fisher’s debt-deflation cycle, something Greece is in the middle of.

According to Professor Mody, “The debt-deflation spiral always outpaces the returns from structural reforms.

“He claims that the policy measures proposed to improve the situation will make matters much worse.

The next logical leap is in understanding that if austerity is so problematic and unsustainable then why do the EU nations insist on it so much? Well a collapse of Greece would damage the political goal of this united European project.

It could also spur other countries to leave and cause further problems.

On the other hand a bailout package without austerity puts leaders of other EU nations in a compromising position within their countries.

Taxpayers from Germany don’t want their money to assuage Greece’s problems given their poor financial history and any leader that supports such a measure would become unpopular domestically.

Hence we get this narrative of helping the Greeks by giving them money and also imposing reforms to sway public opinions.

But these reforms are really incompatible with any tangible improvement of the crisis if they follow the likes of these destructive austerity measures.

Well what can actually help Greece’s economy return to normal functioning.

The only route out of this crisis is with debt relief or with a default and since a default can have ripple effects all over Europe, it seems debt relief is the only viable option.

Some analysts even contend that the IMF should have never lent Greece the money initially and should have let a default occur.

Private banks should have shared the costs of the crisis that occurred in 2009 as they handed out loans irresponsibly.

Along with debt relief, goals should be set on the GDP primary surplus Greece should achieve with long term social policies aimed at VAT rates, wages and pensions.

The priority however should be to prevent the aggravating depression and debt-deflation cycle which can only be done through immediate relief.

Having analyzed the entire situation it makes one think that surely the worlds leading economists and politicians can deduce the best plan of action from bare economic facts despite knowing that often, political interests and considerations determine economic outcomes.

But it turns out that sometimes Economists can just get it wrong.

Paul Krugman in his article in the NY Times discusses how the European Commission adopted an economic policy claiming, “slashing spending in a depressed economy actually creates jobs because it boosts confidence.

” These ideologies were motivated by political scenarios and were justifications for imposing austerity measures on debtor nations, argues Krugman.

This is confirmed in the Op-Ed article written by Germany’s finance minister, Wolfgang Schäube who believes that austerity leads to confidence and that leads to growth.

“All this is a flat-out rejection of everything we know about macroeconomics, all the insights that European experience these past five year confirms,” writes Krugman.

Whatver may be the ultimate end of this complex solution one cannot but help empathize with the Greek people who are sandwiched between governments failing to fulfill promises and European leaders driven by a moral veneer.

Specifically the Greek youth of age 25 – 30 and under, face an unemployment rate of 62 per cent.

30 per cent of young unemployed people are either undergraduates or postgraduates.

This is the same generation that saw Greece win the European Football Championship and the opening ceremony of the Olympics.

Now they turn to the rest of the world as economic migrants seeking jobs.