by Gary Clyde Hufbauer, J. Bradford Jensen, and Euijin Jung, Peterson Institute

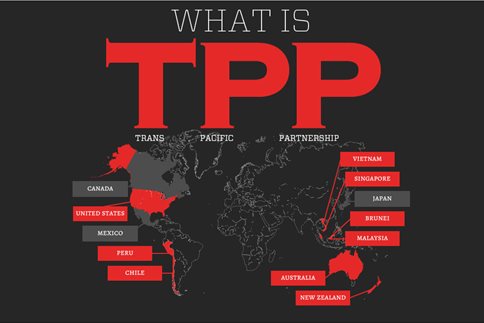

All the media buzz surrounding the conclusion of the Trans-Pacific Partnership (TPP), a megaregional trade deal between 12 nations, largely neglected to identify one big winner: the vast US service sector.

The Wall Street Journal highlighted US agriculture, manufacturing, and technology companies as TPP winners, but it missed the point that, in terms of forecast export gains, the biggest TPP winners are US services firms.1 Even Goldman Sachs, a major service supplier, neglected to mention the favorable impact of wider access to Asian service markets.2 This post tries to deal with the attention deficit by illuminating gains to the large service sector of the US economy.

Peter Petri and his colleagues (2012) provide the best quantitative projections for the economic impact of TPP.3 Their estimates indicate that, for all TPP members, exports of manufactures will increase by $209 billion when the agreement is fully implemented some 10 years hence. Exports by all TPP members of services will increase by $99 billion by 2025. However, for the United States, the magnitudes are reversed. Under the TPP, US exports of services are projected to increase by $68 billion, somewhat larger than the projected increase of $53 billion for US exports of manufactures. In fact, US firms will claim the giant’s share of service export gains enabled by the TPP.

Two main reasons explain this outcome. First, US service firms are exceedingly efficient and enjoy a large comparative advantage in exporting transport, travel, financial, and business services. The United States has a huge pool of highly educated human resources, and the widespread use of information technology has enormously strengthened the US service sector compared to other TPP countries. The second reason is that high barriers to service imports and investment that now prevail in TPP countries will be lowered. The barriers include outright bans, quotas, restrictive licenses, buy-national procurement rules, and discriminatory access to distribution networks.

Compared to most other countries, the United States already provides a better environment for foreign companies in the service industries. The US scores on the Organization for Economic Cooperation and Development (OECD) Services Trade Restrictiveness Index (STRI) are lower than the OECD averages in 11 sectors.4 For example, in legal services, the United States has the lowest score (0.12) while Mexico has the highest (0.53). Very low US scores in the motion picture industry (0.06) and sound recording (0.05) also indicate a business-friendly environment. By implication, other TPP members will liberalize their service market access barriers to a much greater extent than the United States.

Back-of-the-envelope calculations suggest the elimination of global barriers to business services would increase US service exports by a massive $300 billion when fully implemented.5 Fontagné, Guillin, and Mitaritonna (2011) have translated service sector barriers imposed by several countries into tariff equivalent figures.6 In communication services, barriers in Japan and Singapore are estimated as 63 percent tariff equivalents, followed by Mexico with 56 percent tariff equivalent barriers. Removing an outright tariff of 56 or 63 percent would bring shouts of joy; dismantling equivalent regulatory barriers should also be cause for celebration. In financial services, New Zealand and Australia are the most restrictive. Such high barriers have long hindered US service firms from selling to foreign markets.

Reforming this worldwide pattern, TPP members have now agreed to provide fair and equal treatment to foreign firms that seek to enter their service markets through trade, investment, or both together. New restrictions on market access are not allowed, and foreign suppliers need not establish residence in other TPP countries in order to access their markets. A full dismantling of services trade and investment barriers is equivalent to meeting the four benchmarks enumerated in the General Agreement on Trade in Services (GATS): cross-border sales, consumption abroad, a commercial presence abroad, and allowing for the temporary movement of persons. For example, under the TPP, Japan may have to remove existing restrictions on foreign ownership in its service sector.

The Korea-US Free Trade Agreement (KORUS) offers a good precedent because US exports of services have shown steady growth since the agreement entered into effect in March 2012. Korea lifted restrictions on market access for US service firms, such as limits on the number of permitted service firms in a sector and the maximum value of service transactions. Under the KORUS, US service providers have also taken advantage of reforms in the Korean market. US services exports to Korea increased from $16.7 billion in 2011 to $20.7 billion in 2014, a 24 percent rise.7

Korea is not a TPP member, but US experience in the Korean service market previews potential gains in a much larger market once the TPP is ratified. In this additional, if largely overlooked, manner, the TPP offers a true service to the American economy.