By Desmond Lachman, The Hill

One has to know that the International Monetary Fund (IMF) is doing something right when, in a recent speech, Greek Prime Minister Alexis Tsipras blasts the organization for its unconstructive role in his country. This is especially the case when the two grounds for his criticism are, first, that the IMF is insisting that Greece become very much more serious about its structural economic reform program, and second, that the IMF is demanding too much of Greece’s European partners by way of extending Greece debt relief.

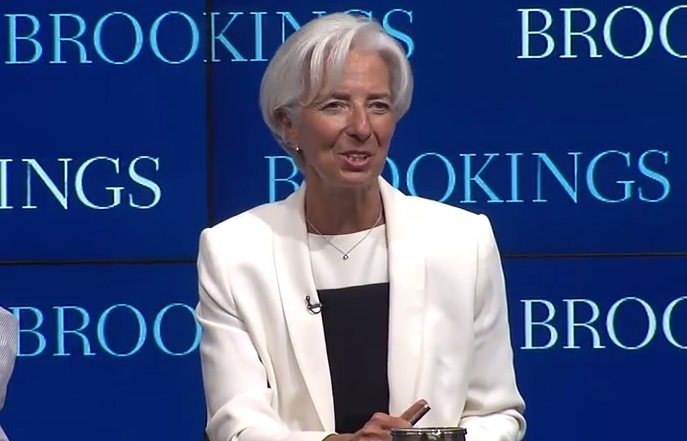

For taking now the firmest of stances with Greece in the face of intense European political pressure, Christine Lagarde, the IMF’s managing director, is to be applauded. In the year ahead, it is to be hoped that she sticks to her guns by insisting on both serious structural reform and major debt relief as the two basic conditions for the IMF’s renewing its Greek lending program, which is due to expire in March 2016. This would not only be for the sake of restoring IMF credibility, but also for the sake of Greece’s future welfare.

To say that Greece’s economy is in the greatest of shambles would be a gross understatement. Five years after its debt crisis began, the Greek economy is now experiencing an economic depression at least on a par with that experienced by the United States in the 1930s. Of particular concern has to be the fact that this depression shows little sign of abating and that youth unemployment remains stuck at over 50 percent. It is also disturbing that, absent further debt restructuring, Greece’s public debt to gross domestic product (GDP) ratio is headed to rise to well over 200 percent of GDP.

To its credit, the IMF has recognized that a major source of Greece’s economic collapse over the past few years was the application of an overly ambitious fiscal adjustment program in a euro straitjacket without the support of far-reaching structural economic reforms. In that context, some two years ago, the IMF refreshingly admitted that it had grossly underestimated Greece’s fiscal multipliers in the design of its initial Greek adjustment programs. Learning from that experience, the IMF is right now to insist that the further budget adjustment that Greece needs to make must be accompanied by far-reaching structural economic reforms that might radically change Greece’s investment climate and put the country back on a long-term economic growth path.

On insisting that the IMF should extend its lending program when it expires next March without demanding serious structural economic reform, Tsipras seems to have learnt nothing from Greece’s recent dismal economic experience. In particular, he seems not to have learnt that continuing to apply fiscal restraint in a euro straitjacket without structural reform is a sure recipe for a prolongation of Greece’s economic depression.

Tsipras also seems to have chosen not to understand that the IMF’s mandate is to support a country’s economic efforts only when those efforts have a reasonable chance of correcting a country’s basic macroeconomic imbalances. The IMF also has a mandate to lend to a country only when it has a reasonable assurance that it will be repaid. It is in that context that Lagarde is to be commended for having learned from Greece’s own recent experience that its economic program will not work without serious structural economic reforms and that the IMF will not be repaid without Greece being relieved of its inordinately heavy public debt burden.

Over the past few years, the IMF’s credibility had been tarnished by its having been overly lax in the application of its own rules. Greece now offers the IMF the chance of restoring its credibility. One has to hope that after having made a good start, Lagarde will take full advantage of that opportunity to restore the IMF’s credibility, which would be in the long-term interest not only of Greece, but of all of the IMF’s member countries.

Lachman is a resident fellow at the American Enterprise Institute. He was formerly a deputy director in the International Monetary Fund’s Policy Development and Review Department and the chief emerging market economic strategist at Salomon Smith Barney.