by Vasko Kohlmayer, FrontPage Magazine

"Société Générale has advised clients to be ready for a possible ‘global economic collapse' over the next two years," reported the UK Telegraph in a recent story.

Headquartered in France, Société Générale (SG) is one of Europe's largest financial services companies. One of the oldest banks in France, it is also a quintessentially mainstream institution whose leadership is largely blind to the shortcomings of the world's current monetary regime.

As so many other mainstream outfits, SG failed to see the coming of the current crisis and had to be rescued to the tune of billions of dollars. Much of it, paradoxically, came from the American taxpayer via the AIG bail out.

One can get a good sense of how bad things must be if an institution like this is preparing its clients for the possibility of a "global economic collapse." Given the present state of affairs, the bleak outlook is more than justified.

To begin with, many governments currently find themselves on the verge of bankruptcy. Having tried to spur economic growth through vast injections of new money, they have contracted immense public debts. "High public debt looks entirely unsustainable in the long run. We have almost reached a point of no return for government debt," concludes Société Générale in its report.

Leading the way is the United States which posted a deficit of nearly 10 percent GDP during the last fiscal year. The Obama administration projects that America's national debt will exceed its annual economic output in the 2011 fiscal cycle. It will then continue expanding as far as the eye can see, reaching 107 percent of GDP in 2019. It should be remembered that these are the administration's own figures, which almost always tend to be too optimistic. The reality is likely to be worse.

The deep indebtedness of western governments raises serious questions about their financial viability. Ambrose Evans-Pritchard, the Telegraph's International Business Editor, puts it bluntly: "Almost all western governments are insolvent… we are bust." Evans-Pritchard is correct. The level of indebtedness is unsustainable. Unable to squeeze much more from taxes, sooner or later western governments will have to start defaulting. The default will very likely take the form of high inflation as governments will try to print away their immense debt burden. This will, of course, have dire economic repercussions.

Dire as Société Générale's report is, it still does not do full justice to the dept of our predicament. When discussing America's fiscal plight, for example, it fails to take into consideration the biggest drag of all – entitlements. Estimated at more than $100 trillion, this astronomical figure represents the largest financial obligation in the history of the world. More than one and a half of the world's current economic output, entitlements are a millstone that will pull America down into financial ruin. Needless to say, the rest of the world will also be caught in the vortex. With Social Security going into the red perhaps as early as this fiscal year, the "global economic" collapse may occur sooner than later. Western government officials, however, appear unconcerned about the black clouds on the horizon. Rather than trying to rein in spending, they blithely pile on even more debt. Oblivious to the impending financial crack up, they instead worry about the non-existent anthropogenic global warming.

Meanwhile, the banksters managed to pull off another one, this time in the United Kingdom. On Tuesday last week it was revealed that Britain's central bank – the Bank of England – had extended in October 2008 secret loans to two large banks. The amount involved was £67 billion, which is roughly $100 billion. The news provoked a furor across Britain with the public, politicians and commentators outraged at the secretiveness in which the transaction was executed. But the outrage has prevented people from seeing the more fundamental issue. So far no one has asked the most important question: Where had the money came from? Obviously it did not come from the government's budget as such a huge expenditure could not have gone undetected.

The secret loan was an extra budgetary transaction by the Bank of England. But how did the Bank of England get all this money? It simply created it out of thin air and then pushed it to those in trouble. The ability of central banks to create new money at will is really nothing other than legalized counterfeiting. Whenever the monetary elite needs to bail out their friends in some troubled economic sector, they simply send some freshly minted cash their way. But these huge inflows of new money dilute the existing money stock thus decreasing the value of the money that is held by the general public. The result is inflation. And although it may not be immediately reflected itself in the Consumer Price Index, it will sooner or later show itself somewhere. The current rise in prices across investment asset classes such as gold, equities, commodities, etc. is to some extent due to the inflationary monetary policies of governments across the globe. To put it differently, currencies are losing value in relation to tangible assets.

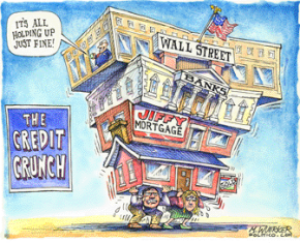

Everyone should be able to recognize that it is not possible to solve real problems by contracting ever more debt and by printing ever more money. And yet this is exactly what governments have been doing. This game cannot last forever and the house of cards they have built will sooner or later come crashing down. The "global collapse" of which Société Générale warns is a real possibility. Those who choose to ignore such warnings do so at their own peril.