Written by Elliott Morss, Morss Global Finance

Over the last two decades, the trade-offs between more rapid economic growth and the need for governments to keep their financial houses in order has been a topic of worldwide debate. Controversy over the issue has intensified recently with governments trying to counter the global recession. In this two part series, the issue is investigated by examining the changing perspectives of four of the most important global economic players: China, Europe, the US and the IMF. Part 1 focuses on Europe and the IMF.

Austerity/Growth Analytics

Most economists agree that at least in the short run, a reduction in taxes and/or an increase in government expenditures will stimulate spending, increase GDP growth, and reduce unemployment. These actions will also increase the government deficit. The obverse is also believed to be true, i.e., a reduction in the deficit, caused either by an increase in taxes or a reduction in government spending, will at least in the short run reduce spending/growth, and cause unemployment to rise. Austerity advocates point out that government deficits cause government debt to increase and that in turn leads to higher borrowing costs. Consequently, they conclude that governments should use deficits to stimulate growth sparingly.

The fact that all Eurozone countries use the same currency means there are further limits on what they can do. Unlike countries with their own currencies that can print money, Eurozone countries cannot: their money supplies depend on what they take in via taxes/other revenues, international trade and what they can borrow.

Europe and the IMF

Perhaps the best way to see how the austerity/growth controversy has evolved in Europe and the IMF is to examine the interplay between the IMF, the European Union and the European Central Bank in working to “bail out” the Eurozone’s “weak sisters (WS)”: Greece, Italy, Portugal, and Spain.

Summary of What Happened

European banks gambled depositors’ monies to buy risky sovereign debt – most notably Greek debt. These ready buyers of WS’ debt kept interest rates down and gave WS governments the green light to continue down unsustainable economic paths. Since 2010, the European Union, the European Central Bank, and the IMF have negotiated austerity bailout programs for these countries. And since then, the economic condition of all WS countries has worsened. And it is very unclear what the future holds.

With this as a backdrop, consider next how the austerity/growth issue has played out between Europe and the IMF. In Europe, there are only two actors that really matter: Germany and the European Central Bank. Both believe the only solution for WS is austerity. They believed it in 2010 and they believe it now, despite the deteriorating economic conditions in all four WS countries. The following quote from Jean-Claude Trichet, the president of the European Central Bank, reflects the views of Germany and the ECB:

“the idea that austerity measures could trigger stagnation is incorrect….a credible fiscal-consolidation plan will restore confidence and foster economic recovery.”

The IMF’s job since inception in 1945 has been to get countries to agree to austerity programs. In return for meeting performance targets, mostly having to do with reducing the government deficit and slowing the rate of increase in the money supply, the Fund makes loans to governments. The money is given out in tranches, providing the country continues to meet agreed-upon performance targets.

In recent years, the IMF has been asked to take on assignments that involve growth rather than austerity. A fair assessment of their success on these assignments is that it is a “work in progress”. Unemployment problems have never been a focal point of the IMF. But in 2008, it completed a research study that concluded a 3% reduction in government deficits would cause a 1 percentage point increase in unemployment. In short, the Fund found that austerity increases unemployment.

Focus on Greece: Greece is the extreme case of WS economic problems. EU/ECB and IMF actions there give the clearest picture of their thinking on what should be done to turn around all WS countries. In 2009, the EU and ECB asked the IMF to negotiate and monitor a €110 billion austerity program with Greece. The Germans wanted the IMF involved to specify and police the performance terms Greece would have to meet to get tranches of monies released. What the IMF ended up asking Greece to do was remarkable. It went far beyond the normal IMF agreement calling for a smaller government deficit. In fact, as I later observed:

“In all the years I have been covering the IMF, I have never seen such a long list of policy changes being demanded of any country.”

Reforms were called for in the following areas: fiscal, pensions, health sector, Social Security, government performance, labor and overall economic system. In order to achieve these objectives, the Greek government agreed to foreign technical assistance in more than 20 different fields. This was far from a typical IMF stand-by agreement. This was not just a plan to cut the government deficit. This was a program intended to make the Greek economy competitive with the German economy. Certainly in the short run it was a complete disaster. But for the longer term, the IMF was right: if the Eurozone was not to break up, all four WS would have to implement reforms called for by the IMF if they were to be competitive with Germany.

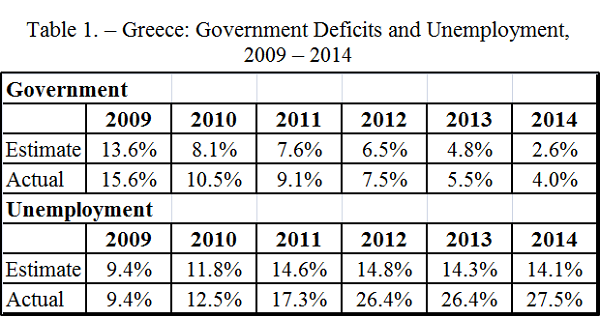

Estimates made in 2009 in support of the agreement are presented in Table 1 along with actual outcomes. The differences between the projections made in 2009 and the actual outcomes/projections for 2013 and 2014 are shocking, particularly the unemployment estimates. In 2009, unemployment was projected to rise to 14.8% in 2013; it actually increased to 26.4%! It is amazing that the IMF, an organization that has been arranging and overseeing austerity programs for countries for 68 years could be so far off on estimates of the effects of its austerity programs on unemployment.

Source: FocusEconomics: Euro Area, Consensus Forecast, March 2013

In 2012, Oliver Blanchard, the chief economist of the IMF and Daniel Leigh, another IMF economist, reviewed the IMF’s earlier research findings on the unemployment effects of a reduction in the government deficit. They concluded the earlier unemployment multiplier estimates were too low. Their new research suggested that the effects of a 3% fiscal consolidation would result in as much as a 1.8 percentage point increases in unemployment. Of course, this doubling of the unemployment multiplier does not explain the huge unemployment expansion in Greece. The Greek economy was in a free fall before the EU/ECB/IMF austerity program was introduced. The IMF should have known this and incorporated the free fall into its projections.

The Two IMF Faces

The IMF has two faces – the political/public one and what its trained staff really thinks. This became even clearer when Lagarde took over. Lagarde focused on raising money to bail out the European banks. She was not focusing on the austerity/growth issues. But the IMF economists were. And the disaster taking place in Greece resulting from the austerity program had their attention. And gradually, they got Lagarde to give some time to the effects of the austerity programs, in Greece and elsewhere in the Eurozone.

By January 2012, IMF support for austerity in Greece had ended. The Fund never conceded what horrible miscalculations were involved when setting targets for the initial Greek bailout, but it was going in a different direction. Unfortunately, it could not convince its EU/ECB partners to go along. But following a few more months of debate, the IMF at least convinced the EU/ECB to allow weak sister countries more time to reduce their government deficits. Lagarde is going along with the IMF staff on this. She also insisted that the second bailout for Greece needs to be increased by ‘tens of billions of Euros”.

Switching from Austerity to Growth: What Does It Mean?

Ever since the now French President Hollande came on the scene, there has been much talk about switching policies for WS countries from austerity to growth. What does this mean in the IMF/EU/ECB context? There is nothing promising in what the IMF is saying on the transition austerity to growth. Growth apparently means WS must get their costs down so they can compete with Germany. How to get there? Greece and Spain must cut jobs and wages. And in return, the IMF/EU/ECB will give these countries a little more time to reduce their government deficits. Putting this all together means unemployment rates will continue to rise.

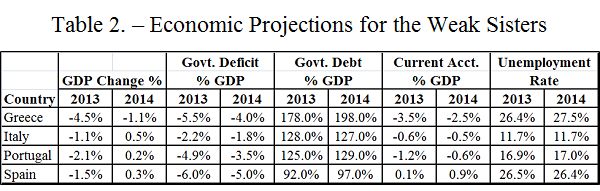

Arguments between the EU/ECB and the Fund continue. But the Fund has staked out a position on its own. It is saying government debts in excess of “X” percent are not sustainable. Referring back to Table 1, this means the Greek debt burden of 178%, projected to rise to 198% by the FocusEconomics Consensus in 2014 is not sustainable. However realistic this position might be, it is not what the EU/ECB wants to hear. It will mean another Greek default and European banks taking another hit.

Conclusion

“Sleepwalking” is the best way to describe what is going in Europe right now. The IMF talks of reducing the debt burden while German Finance Minister Wolfgang Schaeuble insists that debt cuts are legally impossible if linked to a new guarantee of loans. But if not linked to new loans, how will the WS find the Euros they to survive over the next few years?

So what is next? More austerity? Reduce the government deficit further? What is the target unemployment rate? 30%? Keep in mind that Greece has no Euros left, so government deficits going forward must be financed by new borrowings. And all of this talk, just to get the Weak Sisters through the current crisis. What then?

Table 2 provides projections from FocusEconomics Consensus on key data for the WS for this year and next. Look across the numbers for Greece. Hopeless. Italy is not nearly as bad. But with debt at 128% of GDP, it has to worry about “contagion” from Greece and a spike in borrowing costs. Both Portugal and Spain are projected to reduce their government deficits dramatically. Have the austerity effects of those reductions been factored into its projected GDP growth and unemployment? I doubt it.

Source: FocusEconomics: Euro Area, Consensus Forecast, March 2013

There are two primary Eurozone imbalances that need to be addressed:

- Unemployment rates – with some countries at full employment and others with 50% of their younger workers without jobs, how can a “zone” with a single monetary/fiscal policy and little migration get unemployment rates down without causing inflation in countries at full employment?

- The competitiveness gap – without using the devaluation adjustment mechanism, how will Greece et al ever be able to compete with Germany?

I don’t see how. Of course, a breakup of the Eurozone will have its own risks and consequences. But until then, the Eurozone remains a ticking time bomb. Riots, political turmoil, contagion and general uncertainty will continue.