Greece is rolling out the red carpet for Chinese investors as a means of stabilizing its shaky economy.

By

Officials in Brussels and Washington may view China’s global shopping spree with alarm, as the Asian power house continues to buy up companies, sovereign debt, ports, and bridges around the world. But the Greeks are already dusting off the red carpet.After global rating agency Fitch upgraded Greece's sovereign credit rating from CCC to B- last week, Mr. Samaras tried to convince Chinese officials that the economic crisis plaguing Greece would soon come to an end.

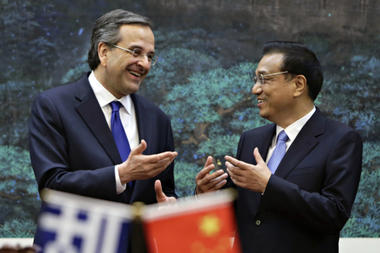

On a five-day visit to Beijing that ended Monday, Greek Prime Minister Antonis Samaras eagerly invited the Chinese to "join Greece's success story," hoping to lure the country’s ravenous investors to Greece and pump new life into the country's devastated economy."I wouldn't be here if we in Greece hadn't turned our ship around," he told them during his visit, flanked by 71 Greek businessmen and members of his cabinet, who had to pay their own way to Asia because of budget austerity measures.

After global rating agency Fitch upgraded Greece's sovereign credit rating from CCC to B- last week, Mr. Samaras tried to convince Chinese officials that the economic crisis plaguing Greece would soon come to an end.

"I wouldn't be here if we in Greece hadn't turned our ship around," he told them during his visit, flanked by 71 Greek businessmen and members of his cabinet, who had to pay their own way to Asia because of budget austerity measures.

A way out of debt for Greece?

After six years in recession, the unemployment rate in Greece has reached 27 percent, and 64 percent for those under the age of 25. In the first quarter of this year, the economy contracted 5.3 percent, the fifth consecutive year of negative growth.

Hoping to turn things around, Greece signed an agreement with its creditors, which hold billions in Greek debt, to raise $67 billion by 2022 by selling off state assets. And the Chinese have already expressed interest in Athens International Airport, along with some of Greece’s 12 ports for lease.

"There's a strong interest from China for infrastructure investments in Greece, especially in ports and railways," says Nicholas Economides, professor of economics at the Stern School of Business at New York University. "Greece will benefit from the efficient running of its infrastructure [brought on by the sale], as well as investment in its infrastructure once those are privatized."

Officials in particular are hoping to replicate the successful partnership between the Greek government and state-owned Chinese Shipping Company COSCO, which they say has revitalized the port of Piraeus and brought in millions of euros in tax revenue. The company has leased half the port since 2010 for 500 million euros in total for a period of 35 years. The Greek government now wants to lease the other half, and COSCO officials have said they are interested.

Samaras and company did not leave China empty handed. Officials from the China Development Bank promised to finance Chinese companies interested in buying Greek assets, while Chinese investors promised to soon visit the country.

And Greece is sweetening the pot for foreign investors. Earlier this month, Greek lawmakers passed a bill offering a 5-year residence permit to non-EU citizens investing in property worth more than 250,000 euros ($320,000). That would allow such investors to bring their families to Greece and at the same time, travel freely within the Schengen zone of 26 European countries.

Worries about China

But Greece's deals with China are not without critics.

Some worry over such arrangements with China, especially whether they would benefit the average voter. Whistleblowers at the port of Piraeus have complained publicly that COSCO has violated Greek labor laws, by underpaying them and not allowing them to form a union. Some ex-workers have even sued the company for those violations.

Another concern is that Greek officials – already under severe pressure from its creditor "troika" of the International Monetary Fund, the European Union, and the European Central Bank – will sell off state assets too cheaply and with few conditions, to the country's disadvantage.

And the EU already is worried about Chinese business practices. European Union Trade Commissioner Karel De Gucht announced just last week he was preparing to launch a formal investigation into telecommunications giant Huawei whose imports into the EU are worth more than $1.3 billion for violating Europe’s competition law.

"Huawei and ZTE are dumping their products on the European market," Mr. De Gucht told Reuters, adding that access to cheap Chinese capital “creates a distorted playing field.”

The day after Mr. De Gucht's announcement, Greek Development Minister Kostas Chatzidakis stopped Huawei's headquarters in Shanghai. The international company has agreed to build a research center and a transit hub in Greece, according to the Greek Ministry of Development.

And during his visit, Samaras shied away from bringing up the usual human rights issues most of his Western counterparts make a point to address while visiting Beijing.

'Not a deus ex machina'

Instead, Samaras kept the talks focused on business opportunities, and used the rich ancient past of both nations as a key reason why China should help Greece.

"If the two countries with the greatest legacies in the world do not combine forces to create such synergies – if we do not do it, nobody else can," Samaras told Chinese officials.

But nostalgia aside, China is firmly rooted in the economic considerations of the present that has led it to become a leading exporter and economic powerhouse, analysts say, scoffing at the hope that Chinese investment could be a panacea for Greek economic woes.

"We shouldn't consider them as a deus ex machina,’’ says Charalambos Paposotiriou, professor of international relations at Panteion University in Athens and author of a recent book about China's rise as a superpower. “They might help with our recovery but we should also become more competitive."

Another recent deal underscores the competition: Greece, which used to be one of the leading builder of ships until the '90s, saw its shipping magnates recently agree to buy 142 new ships from Chinese shipbuilders.

"There might be mutual respect between the Chinese and the Greeks because they're both ancient civilizations,” adds Mr. Paposotiriou. “But people shouldn't forget that China operates according to its interests and profits."