By George Serafeim, Harvard Business review

No matter what happens with the Greek bailout, all parties agree that the Greek economy will have to become more competitive. Many politicians and commentators mention two critical factors in accomplishing this: increasing innovative capacity and reducing bureaucracy. Both are important, but they are far more difficult to achieve than many understand because they are, to a significant extent, influenced by culture.

“Culture” can sound like a catchall, a convenient way to place the blame outside the realm of policy, but I am talking about one specific dimension of culture: avoiding uncertainty.

Different societies deal differently with the fact that the future can never be known, and there is a well-known index to measure the extent to which the members of a culture feel threatened by ambiguous or unknown situations. High uncertainty-avoidance cultures try to minimize the occurrence of unknown circumstances and proceed by implementing rules, laws, and regulations. In contrast, low uncertainty-avoidance cultures accept and feel comfortable in unstructured situations or volatile environments, try to have as few rules as possible, and tend to be more tolerant of change.

The uncertainty-avoidance measure was originally created by Geert Hofstede through a cultural survey of more than 100,000 IBM employees around the world and subsequently confirmed in additional global surveys. The cultural dimensions identified by Hofstede have been used by more than a 1,000 academic studies.

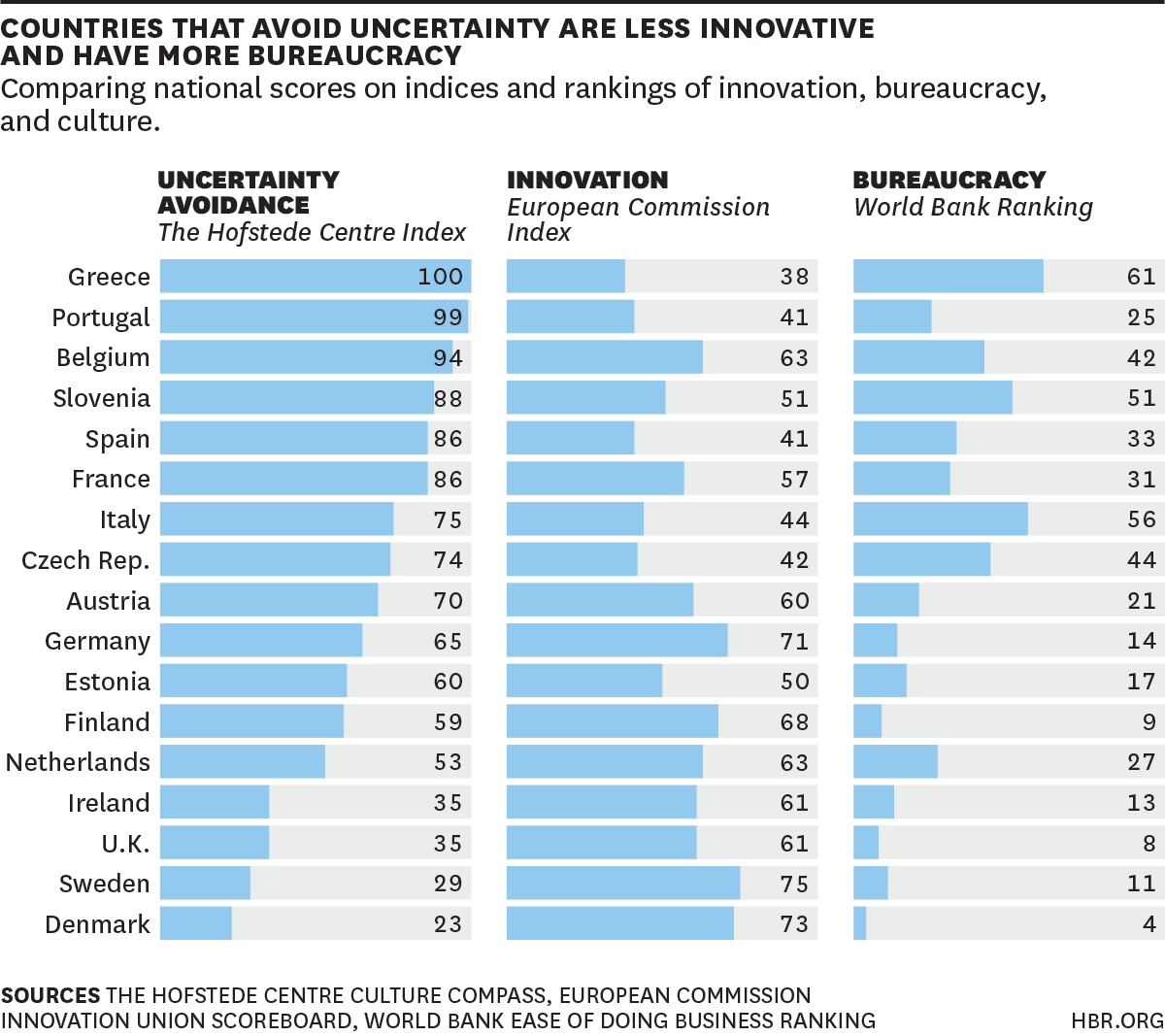

Greece tops this index of uncertainty-avoidance across all countries, scoring 100 out of 100. Greeks’ high level of discomfort in ambiguous situations creates at least two effects. First, they are less likely to take risks – which means they are unlikely to invent new products, processes, or business models. This helps to explain why Greece has one of the lowest license and patent revenues from abroad as a percentage of its GDP, as well as one of the lowest contributions from high-tech product exports to its trade balance. Second, bureaucracy, laws, and rules exert particular influence in Greece because they help make life more structured and less uncertain. In Greece, acquiring construction permits, registering property, and enforcing contracts in courts require vast amounts of paperwork and time.

The data in the graph above demonstrate the link between innovation, bureaucracy, and uncertainty. Countries that score high on uncertainty avoidance score low on innovation (as measured in the innovation union scoreboard of the European Commission) and high on bureaucracy (as measured on the easiness to do business ranking of the World Bank). Sweden, Denmark, Netherlands, the UK, and Finland all have low uncertainty avoidance, high innovation, and low bureaucracy. These countries have excellent research systems with a high number of influential scientific publications, relatively high levels of government and business R&D expenditure and venture capital financing, strong public-private collaborations, and a wealth of intellectual assets in patent applications and community trademarks. At the same time the citizens in these countries spend less time dealing with procedures to start a business, get electricity, register a property, pay taxes, enforce contracts in courts, and trade across borders. Their cultures’ comfort with uncertainty helps to make all of this possible.

This suggests that in addition to short-term policy changes, Greece needs a longer-term cultural shift. We Greeks must learn to accept and tolerate more risk and uncertainty about the future. And it all starts in school. We need to teach children to be courageous enough to take risks throughout their careers and to deal with the failures that unavoidably occur. To do this we must learn from the successes of other countries. Closer collaboration between schools, research institutes, and companies would enable the incubation of new ideas. Inventors’ competitions for young people held every few years could also stimulate new ideas and inspire a new generation of inventors and innovators. Mentorship of small companies by larger corporations and the public sector would also assist the training and professional growth of young entrepreneurs. Finally, the development of venture capital funds would provide the necessary financing for the development of new ideas since such ideas are typically too risky to receive bank financing.

Of course, in the near term, political stability and sound economic policies are necessary to avert crisis. But Greece cannot stop there. In the long term the goal must be broader: to create an economy built around innovation, one that embraces uncertainty.

George Serafeim is the Jakurski Family Associate Professor of Business Administration at Harvard Business School.