by Nikos Chrysoloras & Christos Ziotis, Bloomberg

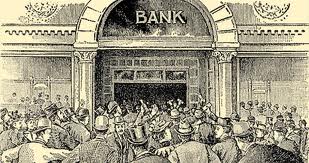

Deposit withdrawals from Greek lenders gathered pace in April as a standoff between the anti-austerity coalition and its creditors renewed doubts about the country’s future in the euro area.

Deposits by households and businesses fell to 133.7 billion euros ($147 billion) from 138.6 billion euros in March, a 3.6 percent drop, the Bank of Greece said on Friday. That brings total outflows since the start of the election campaign that catapulted the anti-bailout Syriza party to power to 31 billion euros, or 19 percent of deposits.

Private deposits slumped to their lowest level since September 2004, amid concerns that the bailout quarrel between the government and its lenders will lead to a redenomination of savings to drachmas, or a bail-in of depositors.

Greek lenders have lost access to capital markets as well as the European Central Bank’s regular financing operations. They rely on more than 80 billion euros of Emergency Liquidity Assistance extended by the Bank of Greece to plug the hole from withdrawals and stay afloat — a more expensive source of funding — while they are forced to participate in liquidity-draining auctions of government treasury bills.

The ECB reviews ELA on a weekly basis and adjusts it to offset deposit outflows. As adjustments can be used as a proxy for deposit withdrawals, ECB Governing Council decisions this month point to a deceleration of outflows in May, on expectations that Prime Minister Alexis Tsipras’s government will reach a deal to avert default.

Fund Transfers

Total deposits in Greece’s financial system fell to 142.8 billion euros in April from 149 billion euros in March, as the state transfered reserves of pension funds, hospitals and regional governments from commercial bank accounts to a Bank of Greece account, for use in short-term financing operations. This internal borrowing is the sovereign’s only source of funding other than tax revenue, as the deadlock in talks with creditors has led to the suspension of bailout disbursements.

Greek banks reported sustained losses in the first quarter as they struggled with record outflows and a recession.

National Bank of Greece SA said Thursday that more expensive ECB funding and higher provisions for souring loans led to a 159 million-euro net loss in the three months. Its deposits fell 8.3 percent from a year earlier. Alpha Bank AE reported a third straight loss on a 14 percent contraction in deposits, while Piraeus Bank SA said its loss was 69 million euros as deposits shrank 15 percent.

“The main factor of uncertainty remains deposit flight, which is likely to accelerate in case of renewed political uncertainty, leading to a liquidity crunch and the introduction of capital controls, before the issue of domestic politics has been resolved,” Eurasia Group analysts Federico Santi and Mujtaba Rahman said in a note to clients on Thursday.

‘Red Line’

Greece’s creditors have said the government must make hard commitments to overhaul its finances or it won’t get a deal to unlock bailout payments.

Talks “are progressing faster but not yet fast enough to conclude,” French Finance Minister Michel Sapin said in interview with Bloomberg at the G-7 in Dresden. “The red line is that there cannot be a deterioration of the overall budget situation, and in fact there needs to be an improvement.”

With time and patience running out, Greece hasn’t yet said how it will pay almost 1.6 billion euros in IMF payments scheduled for next month, with the first transfer due June 5.