ATHENS — Last Friday morning, the Greek prime minister, Alexis Tsipras, gathered his closest advisers in a Brussels hotel room for a meeting that was meant to be secret. All the participants had to leave their phones outside the door to prevent leaks.

A week of tense negotiations between Greece and its creditors was coming to an end. And it was becoming increasingly clear to the left-leaning prime minister that he could not accept the tough economic terms that his lenders were demanding in exchange for new loans.

As Mr. Tsipras paced and listened on the 25th floor of the hotel, his top aides argued that neither Germany nor the International Monetary Fund wanted an agreement and that they were instead pushing Greece into default and out of the euro.

The night before, at a meeting of eurozone leaders at the European Union’s headquarters, Mr. Tsipras had asked Chancellor Angela Merkel of Germany about including debt relief with a deal, only to be rebuffed again.

This is going nowhere, the 40-year-old Greek leader said in frustration, according to people who were in the room with him. The more we move toward them, the more they are moving away from us, Mr. Tsipras said.After hours of arguing back and forth about possible responses, Mr. Tsipras made a decision to get on a plane and go home to call a referendum, according to the people who were in the room.

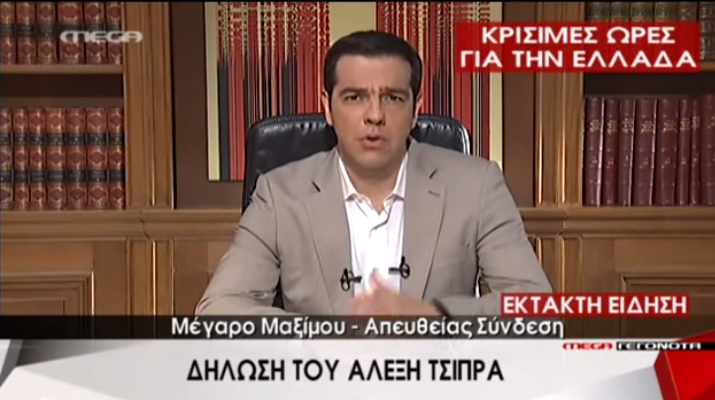

This decision by Mr. Tsipras to ask his people to back or reject, as he had recommended, the latest set of austerity measures for Greece sent shock waves through Europe. Just days before the Sunday vote, the outcome remained too close to call. Many here, however, now think that a “no” vote would ultimately lead to Greece’s exit from the euro.

This referendum will be one of the most important votes in Greece since it became an independent nation in 1830. Why Mr. Tsipras took such an extreme step remains puzzling.

But a close look at the events of the last week — based on interviews with some of the participants and others briefed on the discussions — reveals an accumulation of slights, insults and missed opportunities between Greece and its creditors that led the prime minister to conclude that a deal was not possible, regardless of any concessions he might make.

Greece’s creditors see it differently, of course. In their view, Mr. Tsipras, who swept into power on a wave of anti-austerity support, was only interested in a deal that would go light on austerity measures and deliver maximum debt relief. He could not and would not comply with any agreement that required more sacrifices from the Greek people.

Still, for a week that ended with so much enmity, its start was auspicious.

That Monday, June 22, Greece’s technical team in Brussels submitted an eight-page proposal to their counterparts. The paper was an effort to bridge a six-month divide on how Greece planned to sort out its future finances.

For political reasons, the Tsipras government had said it would not cut pensions or do away with tax breaks that favored businesses serving tourists on the Greek islands. Instead, the new Greek plan envisaged a series of tax increases and increases in pension contributions to be borne by corporations.

Advertisement

Continue reading the main story

The initial response seemed positive. Both Pierre Moscovici, a senior finance official at the European Commission who is known to be sympathetic toward Greece, and Jeroen Dijsselbloem, the head of Europe’s working group of finance ministers who is one of Greece’s harshest critics, said on Tuesday that the plan was promising.

The Greek team was elated. For the first time, the Greek numbers were adding up.

The next morning, though, that optimism evaporated.

Greece’s creditors — the I.M.F., the other eurozone nations and the European Central Bank — sent the Greek paper back and marked it in red where there were disagreements.

The criticisms were everywhere: too many tax increases, unifying value-added taxes, not enough spending cuts and more cuts needed on pension reforms.

The Greek team couldn’t believe it. The creditors had seemed to dial everything back to where the talks were six months ago.

For Mr. Tsipras and his two main advisers — Nikos Pappas, a hot-tempered Scottish-trained academic with a decades-long friendship with Mr. Tsipras, and Yanis Varoufakis, a polarizing economics professor who had spent more than a year schooling Mr. Tsipras in the intricacies of eurozone politics — the rebuke seemed to confirm their most pessimistic views.

Instead of bending as the deadline neared for Greece to make a payment of 1.5 billion euros to the I.M.F., Germany and the fund appeared to be hardening their positions.

On Wednesday night, Greece was presented with a counterproposal. At the behest of the I.M.F., the tax increases had been reduced and, crucially, the government was told that it needed to increase value-added taxes on hotels.

Moreover, several requests by the Greeks to discuss debt relief had been rejected — you need to agree to reforms first, they were told.

On Thursday, Mr. Varoufakis and Mr. Tsipras agreed that they could not present this latest proposal to their cabinet back in Athens. In recent weeks, radical factions within the ruling Syriza party in Greece had become more vocal in opposing any deal that crossed certain lines on pensions and taxes.

Moreover, some within Syriza were even pushing Mr. Tsipras to walk away from Europe altogether and return to the drachma, an approach that the prime minister and Mr. Varoufakis had promised never to consider.Their only chance, the two men agreed, was to push Europe hard for some flexibility on debt relief because without that, their plan had no chance of making it through the Greek parliament.

But when Mr. Varoufakis raised these issues with his fellow finance ministers on Thursday in the cavernous conference hall at E.U. headquarters, he was told that there was little time left for negotiations.

The very appearance of Mr. Varoufakis was something of a provocation by the Greeks. A few months earlier, at the behest of Mr. Dijsselbloem, Mr. Tsipras had stopped Mr. Varoufakis from negotiating face to face with Greece’s creditors, recognizing that the finance minister was more comfortable giving lofty speeches than he was drilling down on technical issues.

Advertisement

Continue reading the main story

Advertisement

Continue reading the main story

Advertisement

Continue reading the main story

From time to time, however, Mr. Tsipras would push Mr. Varoufakis into these meetings, joking to his aides that he enjoyed seeing Mr. Dijsselbloem and Wolfgang Schäuble, Germany’s finance minister, squirm as the Greek finance minister lectured them on the need for debt relief.

This was just such a moment. And perhaps just as predictably, Mr. Dijsselbloem’s response to the request for relief on Greece’s debt was curt.

Yanis, if you keep talking about the debt, a deal will be impossible, Mr. Dijsselbloem said, according to people who were briefed on the exchange between the two men.

A spokesman for Mr. Dijsselbloem said later that his position on Thursday was that there was a large gap between Greece’s proposal and that of the creditors, but that there was still time to reach a deal.

For six months, the clashes between the austere, sleek-suited Dutchman and his imperious, casually dressed Greek counterpart had been the talk of Brussels. There had been threats, shouting matches.

And now they were at it again.

As the meeting dragged on without sign of an agreement, the tempers of others flared as well.

Mr. Schäuble began criticizing Mr. Moscovici, the senior European Commission official, over his positive comments regarding the Greek offer.

Even the latest proposal from the creditors was too lenient toward the Greeks, Mr. Schäuble argued, saying that he saw little chance that he could get it past the German Bundestag, the national parliament of the Federal Republic of Germany.

The only solution here is capital controls, he said, his voice rising.

But Mr. Varoufakis persisted on the issue of Greece’s staggering debt load, ignoring the admonitions of Mr. Dijsselbloem and others.

Then Mr. Varoufakis turned on Christine Lagarde, the French director of the I.M.F.

Five years ago, the fund had given its blessing to the first bailout, doling out loans alongside Europe despite internal misgivings that Greece would be in no position to repay them.

Now the I.M.F. was pushing Greece to sign up to yet another austerity program to access more loans even though the fund had now concluded that their initial misgivings were correct: Greece’s debt was unsustainable.

I have a question for Christine, Mr. Varoufakis said to the packed hall: Can the I.M.F. formally state in this meeting that this proposal we are being asked to sign will make the Greek debt sustainable?

Yanis has a point, Ms. Lagarde responded — the question of the debt needs to be addressed. (A spokesman for the fund later said that this was not an accurate description of the exchange.)

But before she could explain, she was interrupted by Mr. Dijsselbloem.

It’s a take it or leave it offer, Yanis, the Dutch official said, peering at him through rimless spectacles.

In the end, Greece would leave it.