By Holly Ellyat, CNBC

Greece faces many challenges in implementing its third bailout program and mistakes have been made by both other Europeans – who did not handle the Greek crisis in a “rational” way — and by the Greeks who caused a lot of damage by resisting a bailout for so long, European finance ministers told CNBC this week.

Euro zone finance ministers gathered in Luxembourg on Friday ahead of a meeting of the Eurogroup on Saturday, at which major issues facing the region, including sluggish economic growth, unemployment and developments in Cyprus and Greece, are to be discussed.

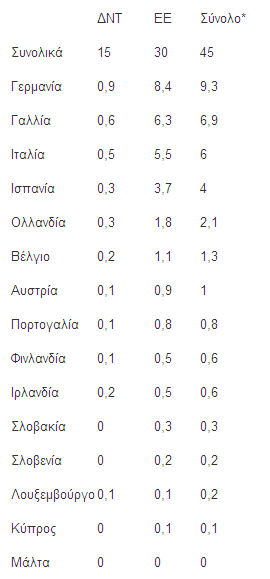

The meeting is the first after a chaotic splurge of talks over the summer at the height of the Greek crisis. The country’s third bailout, worth 86 billion euros ($96 billion), was eventually agreed in July and ratified by several European governments, including Germany, in August.

However, not all finance ministers in Europe agree that a third bailout was the best solution for Greece.

Czech Republic Finance Minister Andrej Babis told CNBC on Friday that the handling of Greece’s financial crisis had deterred his country from joining the 19-country euro zone. The central eastern European country is part of the broader European Union, but does not yet use the euro.

“Everyone knew that Greece was bankrupt and should go out of the euro zone and that the problem will be again on the table in some years, so I am actually against entering the euro zone,” Babis, who is politically centrist, told CNBC.

“It’s hard to explain to people that we have to guarantee the debt of Greece,” he added. “The Greek problem was solved with a political decision, it was not pragmatic or a rational solution.”

Greeks will now head to the polls on September 20 to elect a new government for the fourth time in six years, potentially delaying the first review of the bailout program by lenders that is due in October.

This follows a rebellion among the ranks of the ruling leftwing Syriza party, amid criticism that Prime Minister Alexis Tsipras has capitulated on his anti-austerity stance by agreeing to the terms of a third bailout.

In the wake of this criticism, Tsipras resigned in August, triggering a second Greek election this year, just eight months after coming to power in January.

On Thursday, Pierre Gramgena, Luxembourg’s finance minister, told CNBC that whoever was in power in Greece after September 20 would have to deal with the challenge of implementing the conditions of the bailout, which include large-scale spending cuts, a large privatization scheme of public assets and tough primary surplus targets.

“I think that the new government that will come out of the elections will be faced with a lot of challenges,” Gramgena told CNBC, adding, “I think that we’re going to have regular reviews of the implementation of the bailout package, which is a little bit different from what was done in the past.”

He laid any complaints from Athens about the rescue package at the Greeks’ door, saying that if they had agreed to terms sooner, such a large bailout would not have been necessary.

“The perspective we take in the Eurogroup is that we have found a solution. If the Greek government had acted more quickly and swiftly then the package would have been a lower amount,” Gramgena said.

He added that: “The absence of action from the Greek government has caused a lot of damage and has really put the country back in a recession.”

The latest opinion polls show that Tsipras’ leftwing Syriza party is neck-in-neck with the conservative New Democracy party to win the election, prompting discussions over whether a coalition government may need to be formed.