By Matthew Yglesias

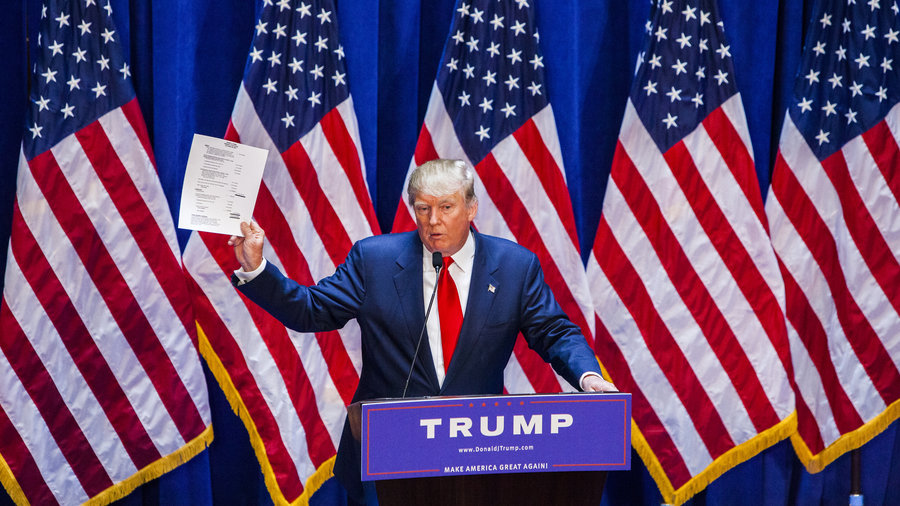

There’s no law that says a presidential candidate has to release his income tax returns, and Donald Trump says he’s not going to do it. Not, at least, until the completion of an ongoing audit of what he says are all his returns since 2009 — an audit that he doesn’t expect will be done until after November.

Every major party nominee for a generation has released tax returns, and so have most serious contenders for their party’s nomination. A candidate’s tax return is rarely a top-tier political issue, but in the case of Trump, it is. The extent to which a President Trump would or would not abide by the norms of American politics is itself a key issue in the 2016 campaign. And for normal candidates, information about financial dealings is a secondary consideration to his or her record in public office and policy plans for the future. But for Trump, his personal finances are his entire campaign.

His record is a record in business, not in politics, and his policy proposals are ridiculous and inconsistent to the extent that it’s almost a category error to critique them. His response to questions about the workability of his plans is always that they are opening bids in a negotiating process and that people ought to have faith in his prowess as a dealmaker. His savvy with money is key to his campaign, in other words, but without the tax forms we really don’t know how savvy he is.

What’s the deal with this audit?

In late March, Trump released a letter from his tax attorneys and accountants attesting to the fact that all of his tax returns from 2009 forward are currently being scrutinized by the IRS. They say that, generally speaking, since 2002 Trump has been audited on an annual basis, in compliance with the IRS’s general approach to unusually complicated individual income tax filings.

The reason Trump’s tax returns are so complicated is that the Trump Organization is a somewhat unusual business venture. A more typical rich entrepreneur might have founded a company that later staged an IPO, and Trump would be rich today because of a mix of salary he has paid as CEO of his own company and because he owns shares of stock in the company.

But the Trump Organization isn’t a company at all. Instead, it’s simply a catchall phrase for a loose agglomeration of approximately 500 separately incorporated entities that Trump either wholly or largely owns. Each of these companies has its own set of transactions each year, which end up registering on Trump’s personal taxes.

So the complexity of Trump’s tax situation is real, and the audits very likely are too. By the same token, the complexity of Trump’s financial situation is precisely why seeing the tax returns would be interesting and could offer valuable insight into Trump.

In case you are wondering, there’s no legal rule saying a person who’s being audited can’t release his returns.

Watch: How each candidate’s tax plan will impact your wallet

Why is Trump reluctant to release his returns?

Of course we don’t know and won’t know unless and until he releases them.

But here are a few leading candidates.

Trump paid very little in taxes

Back during the 2012 presidential campaign, the revelation that Mitt Romney paid only a 14 percent effective tax rate in 2011 became part of a larger argument about Romney as rich and out of touch and benefiting from a rigged economic system. Very wealthy people like Romney are often in a position to benefit from deriving their income primarily from investments rather than working, allowing them to pay a lower tax rate than a typical middle-class American.

On the other hand, Trump might just spin this as an example of business savvy. Romney suffered from a patrician affect that Trump certainly lacks, and Trump has done a pretty good job of casting his past business moves as simply examples of the kind of ruthlessness and intelligence he would like to deploy on behalf of the American people.

Trump’s charitable donations are weird

Donald Trump has claimed repeatedly to have given away more than $100 million to charity over the course of the campaign, which does not appear to be true in any normal sense of the word. Instead of handing over cash, Trump has done things like grant conservation easements on land he owns, including things like a case in California where he agreed to avoid building homes near a golf course and turned the land into a driving range instead.

Several media sources have glossed over this as Trump wanting to avoid revealing how little he’s given away, but what seems more probable to me is that he’s likely to avoid scrutiny of how much he’s abused the charitable deduction to claim breaks for giveaways of little social value.

Trump is hiding ties to organized crime

In a Facebook post urging Trump to release his tax returns, Romney said that “while not a likely circumstance, the potential for hidden inappropriate associations with foreign entities, criminal organizations, or other unsavory groups is simply too great a risk to ignore for someone who is seeking to become commander-in-chief” and that tax disclosure could clear the air here.

There’s almost no chance anything in Trump’s tax returns would reveal anything related to the Mafia, but Romney is likely taking the opportunity to induce reporters to write about the fact that there are credible reports of Trump-Mafia links from back in the 1980s, when he was more heavily involved in the New York and New Jersey construction industries.

Trump isn’t that rich

Back before American politics became a remake of The Dead Zone, it was common to speculate that a desire to avoid real financial disclosure was a key reason why Trump would give up the publicity stunt soon enough. In July 2015, for example, BuzzFeed’s McKay Coppins wrote that “the ‘financial disclosure’ Trump released this week — declaring $9 billion in assets — more closely resembles a dream board than a set of official financial documents. If he actually discloses his tax returns like a credible, real-life candidate, he risks revealing a messier and more modest personal fortune.”

This is probably the most important one. Trump is clearly a rich man, but he was born rich, so whether his wealth reflects actual business skill hinges crucially on how rich he actually is.

How could tax returns reveal how rich Trump is?

The issue here is that Trump’s actual wealth is very hard to estimate. A normal rich person’s assets consist primarily of shares of stock and bonds that trade in widely known public markets. You can assess how rich that person is by owning up how many shares he or she owns and multiplying by the price of the shares in the public market.

This kind of estimate always has its imperfections, because, for example, if Mark Zuckerberg actually tried to sell all his shares of Facebook stock simultaneously, the price would probably crash. But it’s still a pretty good way to get a rigorous estimate of an individual’s net worth in a way that allows for apples-to-apples comparisons.

Trump, by contrast, mostly owns what are known as illiquid assets. A golf course in Scotland, an office building in midtown Manhattan, and the right to license the Trump name brand are all examples of things that unquestionably have financial value. But they are not things that trade in public markets and thus create a publicly known price. Instead, the value of each asset is necessarily a somewhat hazy guesstimate.

Tax returns would not eliminate this problem, but they would give us a clearer sense of exactly how aggressive that $9 billion valuation, is because we could see what kind of return Trump is scoring on those assets. These things do vary considerably in the business world. Facebook’s stock, for example, trades at about 30 times its earnings, while Apple stock trades at only 10 times its earnings. That reflects a market judgment that Facebook’s prospects for future growth are really good while Apple’s are pretty bad.

So there’s no one “correct” answer to how much income Trump would have to be earning for his $9 billion self-assessment to make sense. But tax returns would help us see exactly how optimistic he is being about his own outlook and, since they would cover multiple years, would help us understand whether anything about that optimism is warranted.

Why Trump’s finances matter

Ultimately this all matters because Trump’s case for himself as a candidate hinges crucially on his alleged business prowess. He has no record in elected or appointed office, hasn’t served in the military, and hasn’t really been involved in policymaking or public affairs in any way.

But everyone knows that he is a rich and successful businessman, in part because he talks about it constantly and in part because a large element of his business consists of sticking his name on things. But how rich and how successful is he, actually?

Trump’s father was a multimillionaire, and Trump started off with about $40 million in the mid-70s. Suppose Trump is really worth $1 billion rather than $9 billion. Well, $1 billion is unquestionably a lot of money. But turning $40 million into $1 billion over 40 years of investing would actually be a pretty dismal investment performance compared with putting the money into a passive fund.

If Trump had been born penniless, the fact that he’s clearly rich today would be impressive. But Trump was born rich. So to know how impressive his current rich-guy status really is, we genuinely need a clear picture of exactly how rich he is. Tax returns would give us that in a way that nothing else does.