The he International Monetary Fund just offered Germany a face-saving compromise on the question of Greek debt.

By DAVID FRANCIS, Foreign Affairs Blog

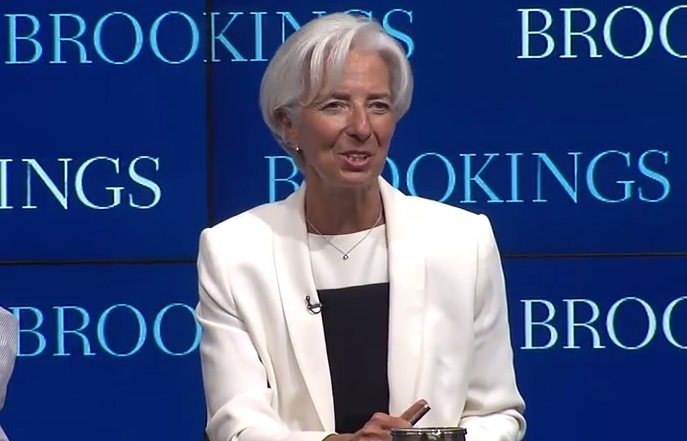

Ahead of a key June 15 meeting of EU finance ministers, and a month before Greece owes a $7.8 billion repayment to its European creditors, IMF chief Christine Lagarde told the German business newspaper Handelsblatt her bank is once again on board with a bailout for the troubled southern European economy — provided Greece’s creditors can find some way to offer Athens debt relief. IMF funding would be conditional on easing conditions on Greece, she said.

“There can therefore be a programme in which the disbursement only takes place when the debt measures have been clearly outlined by the creditors,” she told Handelsblatt.

Lagarde has long demanded the EU forgive some of the $355 billion debt that Greece has run up with its creditors if it wanted continued IMF participation. Outside of Germany, many other EU members, including France, are sympathetic to the IMF’s argument about debt relief for Greece; few think the country can ever pay back what it has had to borrow to stay afloat after its economic implosion after the financial crisis. But it needs some debt relief so that it can tackle its financing woes in the global capital markets, rather than going cap-in-hand to European neighbors.

But Germany has long refused. German Finance Minister Wolfgang Schaeuble has ruled out a debt haircut for Greece as a violation of European rules, arguing it would have to leave the euro in exchange for debt concession.

Lagarde’s concession is welcome for Berlin, but may not go far enough. German officials have indicated the IMF’s participation in the fund — even if in name only — would allow them to release additional, sorely-needed bailout funds. With the IMF agreeing to delay demands for immediate debt relief, European officials, including those in Germany, have indicated they will move forward with the upcoming payment.

And that could well allow Greek Prime Minister Alexis Tsipras to keep the lights on over the summer. Without the latest tranche of bailout funds, he was heading toward a repeat of the summer of 2015, when Greece defaulted on debt, then led a referendum to reject European austerity demands, and then caved and promised spending cuts to get bailout funds. (Tsipras has yet to implement many of the spending cuts he promised.)

But Lagarde just kicked the debt-relief can down the road: Unless Germany and other big creditors have a huge change of heart, there’s little reason to believe her conditions will be fulfilled and the IMF will again fund the bailout.

“The IMF is saying they are in, but they are actually out,” said Mujtaba Rahman, head of the Eurasia Group’s European practice. “It’s a fudge; there’s little to no reason we will now ever see the IMF disburse in Greece,” he said.