by Geoffrey Smith, Fortune

Even Greeks don’t believe their own wish-dreams about being able to keep the euro if they ditch the bailout program.

Anyone still wondering why the new Greek government went into negotiations with the Eurozone like Vin Diesel and came out like PeeWee Herman?

Or why the European Central Bank has effectively shut Greek banks out of its regular lending operations?

This chart kind of makes things clear: in January alone, Greeks pulled over €12 billion, or 7.6% of all their deposits, out of local banks. Bear in mind that Syriza only took office on the 26th, that its brinkmanship carried on for a full two weeks after the cut-off date for this chart, and that outflows probably picked up as the news flow intensified.

We’ll trust you with our government, just not with our money. Source: ECB

We’ll never know exactly where they bottomed. Finance Minister Yanis Varoufakis told Bloomberg Wednesday that they had already started to reverse after last week’s deal (€700 million on Tuesday alone, he reckons), so the February data, as of month-end won’t show the full horror of how things stood on Monday.

The moral is clear. Greeks may have voted for a party that promised them they could keep the euro but ditch the bailout, but even that doesn’t mean they believe their own wish-dreams.

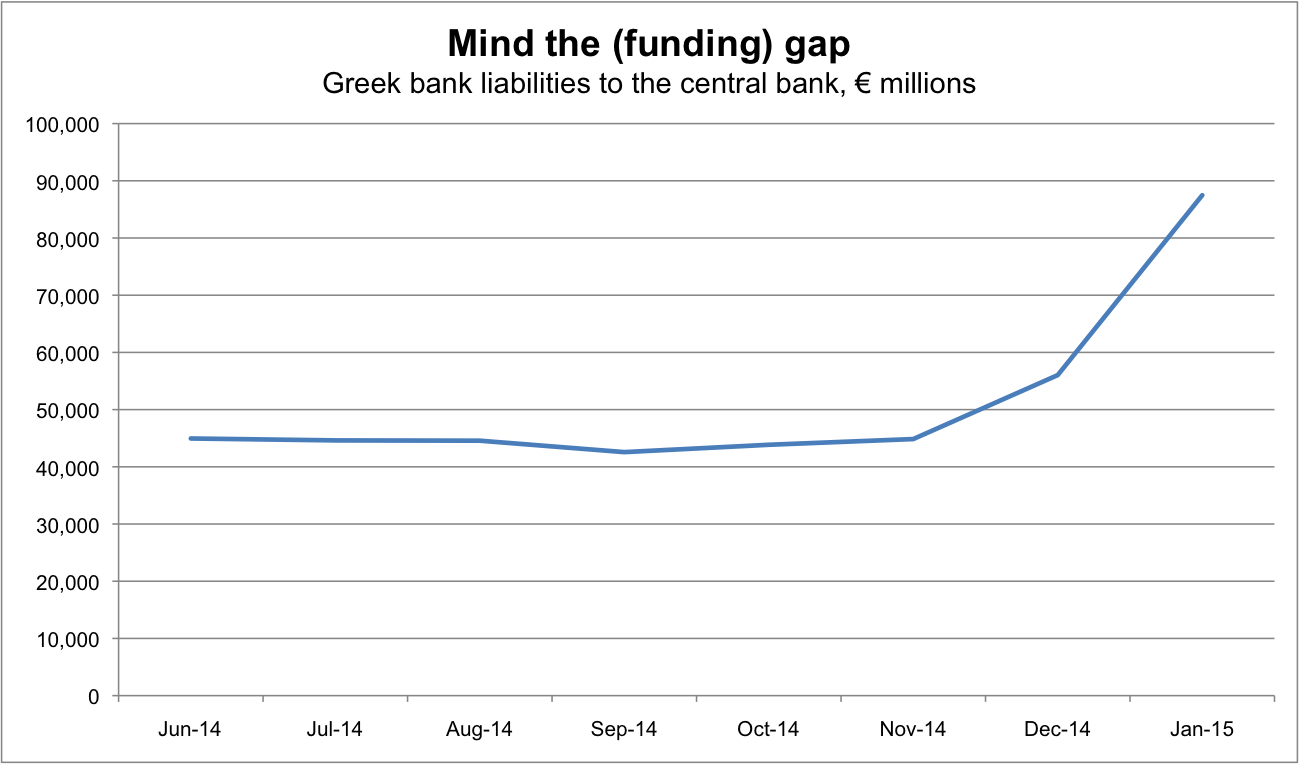

Here’s another chart that shows the flip side of that liquidity coin. When other banks and bond market investors won’t lend to you, and when your depositors are running away, the only thing you can do is borrow from the central bank.

As the deposits flow out, Greek banks are borrowing more and more from the ECB (via the Bank of Greece)Source: Bank of Greece

The thing to bear in mind here is that the ECB has capped at €68.3 billion the amount that it’s willing to lend against debt issued or guaranteed by the Greek government. As the chart shows, they were already borrowing over €87 billion by the end of January. It seems a fair guess that most of the Greek banking system’s remaining assets, down to the contents of the janitors’ cupboards, have already been pledged as collateral too.

So the system is already facing a massive two-way squeeze and the government is only a few bad headlines away from financial collapse. It’s quite possible that some of Greece’s banks would have had to limit withdrawals, or even keep their doors closed, on Tuesday if the Eurozone hadn’t accepted Finance Minister Yanis Varoufakis’ list of proposed reforms and kept the safety net of the loan agreement in place.

That means that Greece can ill afford the kind of inflammatory comments that it indulged in Wednesday. If the rhetoric dies down in the next few days, we’ll know that the point is finally being understood